The United Arab Emirates (UAE) has already taken a major step forward with the introduction of Corporate Tax (CT) in 2023 on its step to Economic Reforms. This is a big deal for businesses and individuals operating in the UAE, as it marks a significant change in the country’s tax landscape. As you can imagine, there’s a lot to learn and understand to ensure compliance and avoid any potential penalties.

If you’re planning to register for UAE Corporate Tax 2023, it’s crucial to familiarize yourself with the key aspects of the new tax laws and the registration process. Don’t worry, we’ve got your back!

At Horizon Biz Consultancy, Dubai, our corporate tax experts have curated a list of nine crucial points you should consider before registering for Corporate Tax in the UAE. This comprehensive guide will help you navigate the ins and outs of CT and make the transition as smooth as possible.

1. Distinct Registration Process from VAT

Heads up! Corporate Tax registration is totally different from Value Added Tax (VAT) registration.

All businesses and individuals involved in commercial activities should register for CT, even if your taxable income is below AED 375,000 or exempt. Keep an eye out for invitations to register from the Federal Tax Authority (FTA) over the next six months, and make sure to register before the tax return submission deadline.

2. Laws and Regulations

No need to stress about separate executive regulations for CT. The decree law for CT has been issued, but there won’t be separate executive regulations. Instead, various cabinet decisions will be issued from time to time, providing details and guidance for implementing CT.

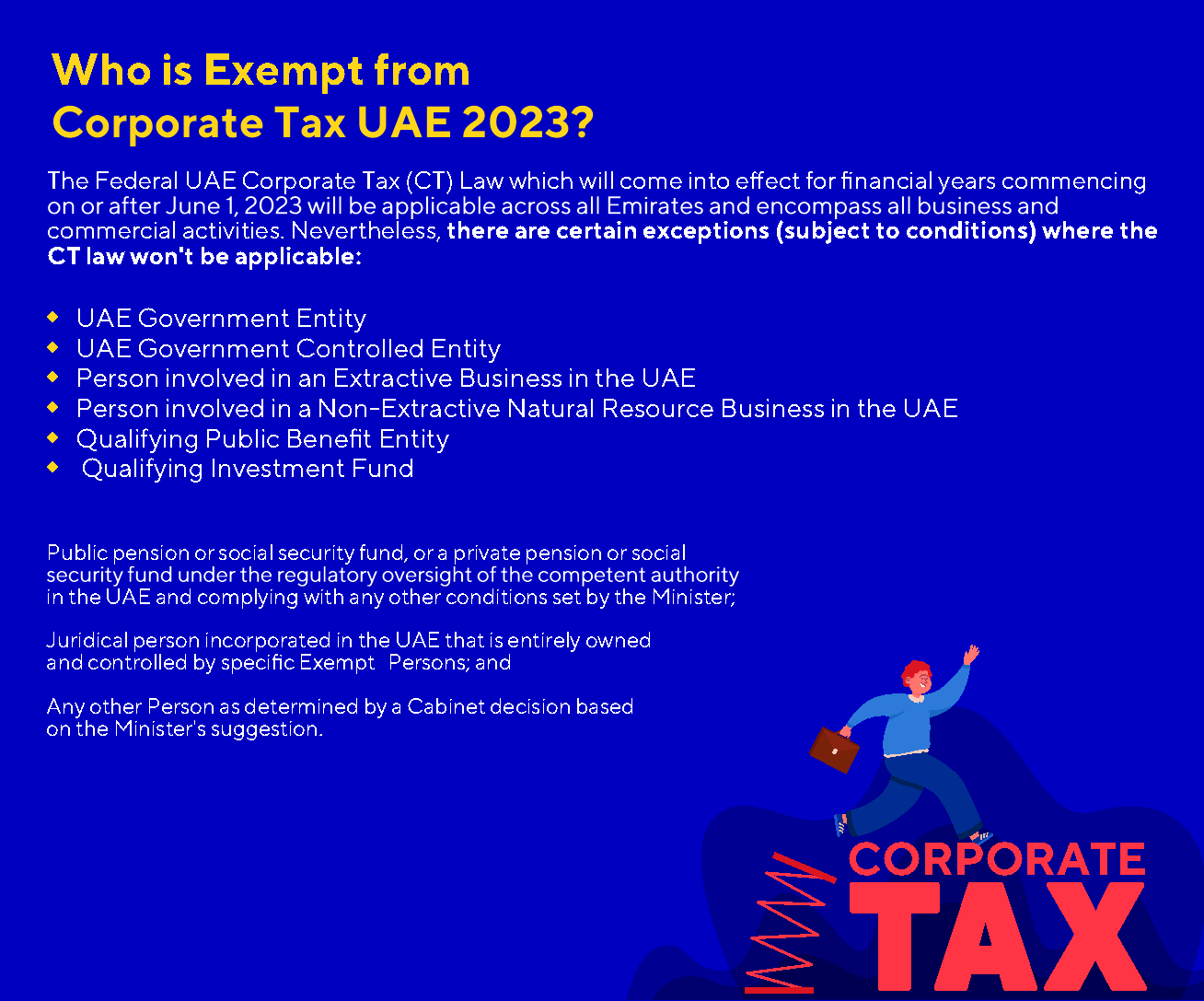

3. Are you Exempt?

If you operate a Free Zone business, be prepared to maintain adequate substance in the UAE and comply with other conditions to enjoy tax exemptions.

In the UAE, income tax is usually dictated by Emirate-level tax decrees, which require payment under a progressive rate system with rates going up to 55%. However, these tax decrees haven’t been implemented in reality. Instead, foreign bank branches are subject to a flat 20% income tax under individual Emirate-level bank decrees. Companies involved in UAE oil, gas, and petrochemical activities face income tax rates of 55% or more under their unique UAE concession agreements or fiscal letters.

4. Taxation of Individuals

Individuals conducting business activities, such as freelancers, social media influencers, sole proprietorships, or civil companies, will be covered under CT. Details about the business categories under CT will be published soon.

5. Businesses with Multiple Entities

A formal approval from the FTA is not required for eligible entities to form a “qualifying group,” but a formal application is needed for forming a “tax group.” The concept of tax groups under VAT and CT laws will be distinct. Hence, having a VAT tax group doesn’t necessitate forming a similar CT tax group, and vice versa.

6. Anti-abuse Provisions

Businesses should have commercial reasons for reorganization. A reorganization aimed at gaining tax benefits without valid commercial reasons could be disregarded under anti-abuse rules.

7. Small Business Relief

In addition to the taxable threshold of AED 375,000, businesses eligible for “small business relief” will be treated as having nil taxable income. The details of small business relief will be published soon. You can read more about SBR related announcements in this article. UAE New Corporate Tax Law April 2023 SBR Update Brings Relief for SMBs

8. Documentation and Accounting Requirements

Taxable income will be determined based on a business’s financial books. There is no need to maintain a separate set of books for tax purposes, as generally accepted accounting standards like IFRS are acceptable. Simplified accounting methods may also be allowed for small businesses and others. Businesses must maintain documents and records for at least seven years, even if they are not taxable, claimed exemptions, or did not pay tax in a specific year. These requirements facilitate future audits and assessments.

9. International Tax Considerations

The Place of Effective Management (PoEM) will be determined by the location of key management personnel, board of directors, and decision-making. Foreign companies with a PoEM in the UAE will be subject to CT. The UAE is committed to the OECD’s Pillar 2, which establishes a global minimum tax of 15% on multinational corporations (MNCs), and will make the necessary announcements in due course.

Understanding these key considerations is essential for businesses and individuals planning to register for Corporate Tax in the UAE. By familiarising themselves with the CT laws and requirements, they can ensure a smooth transition and avoid potential penalties. For an extended guide on everything related to UAE Corporate Tax 2023, you can refer to this ultimate guide from corporate tax experts at Horizon Biz Consultancy.

Contact Us for specific guidance on what the latest corporate tax update UAE 2023 means for your business.