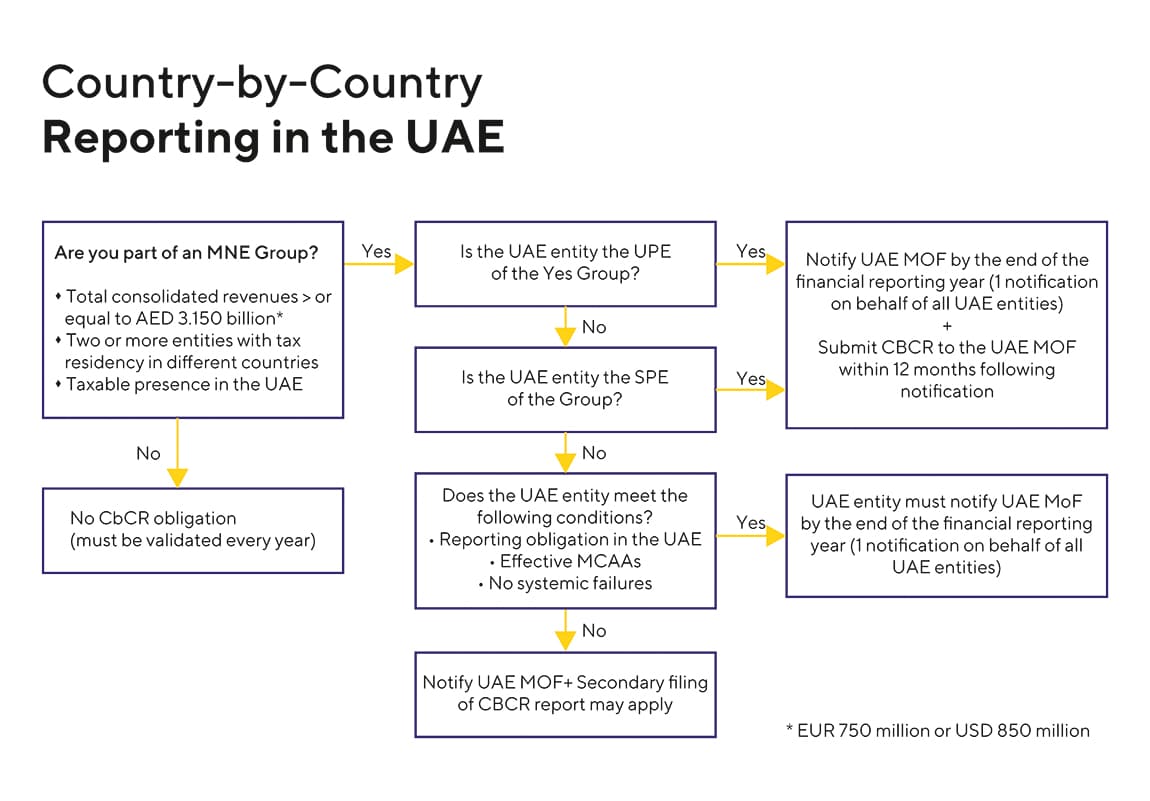

Large multinational entities are mandated to file a Country by Country (CbC) Report as per the Base Erosion and Profit Shifting (BEPS) Action 13, which includes an analysis of their global revenue, pre-tax profit, accrued income tax, and other economic parameters for each country where they conduct business.In the UAE, these CbC Report regulations apply to tax-resident organizations that are part of an MNE with combined revenues equal to or exceeding AED 3.15 billion (EUR 764 million / USD 858 million) in the financial year preceding the “financial reporting year” in question.

At Horizon Biz Consultancy, we understand that Large Multinational Enterprises (MNE) in the UAE need to comply with the Country by Country Reporting (CbCR) regulations. Our team of tax consultants can help you understand the CbC Reporting UAE requirements, conduct the necessary research to determine if your business operations fall within the restrictions, and assist you with compliance. We can help you file the required report with the competent authorities at the end of each financial year, ensuring that your business stays compliant with the regulations.

The reasons for submitting a Country-by-Country (CbC) report in the UAE include compliance with Base Erosion and Profit Shifting (BEPS) Action 13 requirements, transparency in the multinational group’s tax affairs, and assisting tax authorities in identifying transfer pricing and other BEPS risks. The reasons for submitting a Country-by-Country (CbC) report in the UAE include compliance with Base Erosion and Profit Shifting (BEPS) Action 13 requirements, transparency in the multinational group’s tax affairs, and assisting tax authorities in identifying transfer pricing and other BEPS risks.

Moreover, the tax authorities get a thorough understanding of the global allocation of income, taxes paid, and economic activity among tax jurisdictions, allowing them to assess high-level transfer pricing and other BEPS risks across multinational groups.

The CBC reporting is applicable to multinational enterprise (MNE) groups that have a consolidated group revenue of AED 3.15 billion (approximately USD 858 million or EUR 764 million) or more in the preceding fiscal year and where the ultimate parent entity is tax resident in the UAE. The CBC report

is filed by the ultimate parent entity of the MNE group or by a surrogate parent entity on behalf of

There are penalties for not submitting the CbC report on time in the UAE. The penalties are as follows

It is important to note that these penalties can increase if the CbC report is not submitted within a

specific time period or if the violations are repeated.

At Horizon Biz Consultancy, we are committed to helping large multinational enterprises in the UAE comply with the Country by Country Reporting (CbCR) regulations. Our experienced team of tax consultants provides expert guidance on CbCR requirements, conducts thorough research to determine if your business operations fall under the restrictions, and assists with adherence. We

ensure timely and accurate filing of CbC reports, helping you avoid penalties and reputational risks. Trust us to be your trusted partner in CbCr compliance in the UAE.

Enter your information below to receive an email or Contact us today for assistance on +971 50 104 2665