A Tax Residency Certificate (Tax Domicile Certificate), issued by the UAE Ministry of Finance, is an official document for companies at least one year old and individuals who are UAE residents or have lived in the UAE for at least 90 days beginning March 01, 2023. It is crucial for companies and individuals to fully benefit from the extensive double tax treaties and avoid double taxation, which the UAE has signed with over 76 countries worldwide.

The certificate, valid for one year from the date of issue, is issued by the Ministry of Finance to companies operating in the UAE for at least one year and individuals with UAE residency visas or those permanently residing in the country for a minimum of 180 days. Tax Residency Certificate in UAE is not applicable to offshore companies (International Business Companies) because offshore companies are not considered tax residents of the UAE. They are typically registered in tax havens and are not subject to tax in the country of registration.

Therefore, they are not eligible to apply for a Tax Residency Certificate in the UAE. The Tax Residency Certificate is only applicable to companies and individuals who are considered tax residents in the UAE, meaning they are subject to tax in the country based on their business activities or personal income.

Double Taxation is when an individual or business is burdened with similar tax in two different countries for the same resultant income. It can affect the above mentioned scope for multinational growth and international trade relations; which overall limits the latitude of business. In order to avoid the double taxation, the source country, where the taxpayer earns income and the resident country, where the taxpayer is a resident must have signed a Double Taxation Avoidance Agreement (DTAA). As of now, UAE has established 115 DTAA to with most of its trade partners and this list can be viewed from UAE Ministry of Finance (MoF) website.

The applicant has to create an account in the MoF portal and after filing out the application to obtain the Domicile certificate, the applicant can proceed with the payment once the application has been approved[within 2 weeks]. Validity of the same is 1 year.

Minimum Government fee for Individuals is AED 2209/-

Minimum Government fee for Corporate is AED 10209/-

Please note the above mentioned fees doesn’t include Horizon’s professional fee for assistance.

Companies operating in the UAE either on Mainland or in any of the Free Zones that have completed more than 1 year of operations:

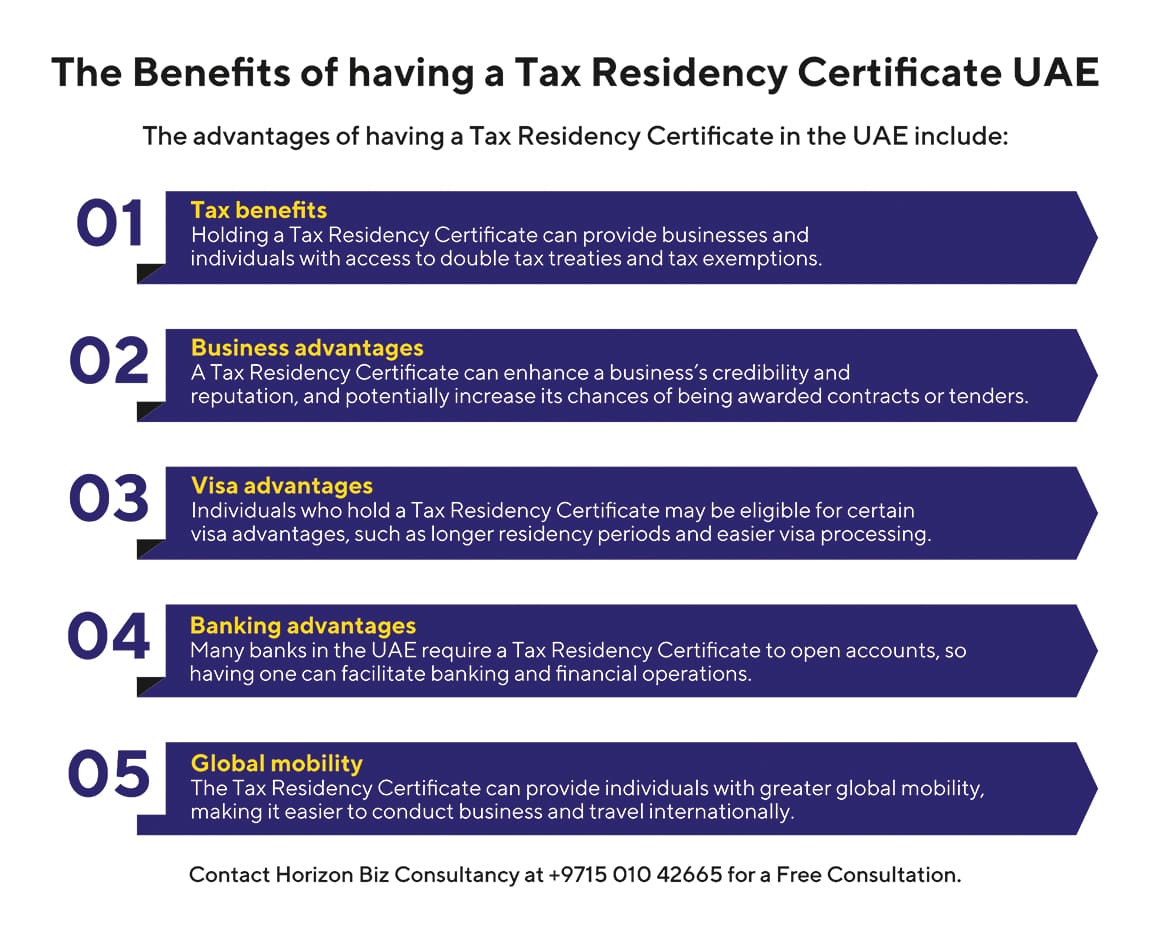

At Horizon Biz Consultancy, our team of experienced tax consultants can assist you in obtaining a Tax Residency Certificate and take advantage of the numerous benefits available to tax residents in the UAE.

We offer a range of services for our clients including

Enter your information below to receive an email or Contact us today for assistance on +971 50 104 2665

To prove UAE tax residency status for Double Tax Avoidance Agreement (DTAA) benefits, bank account openings, tax filings in another country etc.

It certifies the tax resident status and period of your stay in UAE along with associated tax identification numbers.

Main documents needed are Emirates ID, valid residence visa copy, passport, details of stay outside UAE, previous TRCs if available.

The standard TRC validity is 1 year. Our experts assist with yearly TRC renewals if you continue to meet UAE tax residency criteria.

Retrospective tax residency certificates for up to 5 previous years can be obtained if you have sufficient supporting documents.

On average TRC issuance takes 4-6 weeks from the date of application if all documents are in order. We follow-up to expedite.