Understanding external audit fees in the UAE involves navigating complex cost structures that include base audit fees, additional service charges, scope variations, and hidden costs that significantly impact total audit expenses. Business owners frequently ask: “What determines external audit costs, and how can I accurately budget for comprehensive audit services while avoiding unexpected expenses?”

UAE external audit fees vary substantially based on business size, complexity, industry requirements, audit scope, firm category, and additional services, creating pricing structures that range from AED 15,000 for small businesses to AED 500,000+ for large corporations with intricate operations and regulatory requirements.

Effective audit cost management requires understanding fee calculation methodologies, identifying potential hidden costs, implementing strategic budget planning, and optimizing service selection to achieve regulatory compliance while controlling expenses and maximizing audit value for business operations.

How Are External Audit Fees Calculated in the UAE Market?

External audit fees in the UAE are calculated using sophisticated methodologies that consider business complexity, audit scope, resource requirements, risk assessment, timeline constraints, and firm positioning, creating transparent pricing structures that reflect actual service delivery costs and professional expertise requirements.

Fee calculation involves base rate determination, scope assessment, complexity evaluation, resource allocation, risk premium calculation, and market positioning factors that combine to establish competitive yet profitable pricing for professional audit services across different business categories and service requirements.

Understanding these calculation methodologies enables businesses to anticipate costs accurately, negotiate effectively, and make informed decisions about audit firm selection and service scope optimization that align with budget constraints and compliance objectives.

What Primary Factors Drive External Audit Fee Calculations in the UAE?

| Business Size (Revenue) | High | Percentage-based scaling | 0.1-0.5% of revenue | Scope optimization |

| Complexity Level | High | Risk assessment multiplier | 1.2-3.0x base rate | Process improvement |

| Industry Type | Medium | Sector-specific premiums | 10-50% premium | Specialization benefits |

| Audit Scope | High | Time-based calculation | AED 500-2,000/hour | Scope refinement |

| Firm Category | Medium | Market positioning | 1.5-4.0x local rates | Firm selection strategy |

| Timeline Urgency | Medium | Rush premium | 20-50% surcharge | Planning optimization |

Understanding fee drivers enables strategic planning and cost optimization while ensuring audit quality and regulatory compliance through informed decision making about scope and service provider selection.

How Do Different Audit Firm Categories Structure Their Fee Calculations?

Different audit firm categories structure fees through varying methodologies, with Big 4 firms using sophisticated risk-based models, mid-tier firms employing balanced efficiency approaches, and local firms utilizing competitive cost-plus strategies that reflect their market positioning and service delivery models.

Big 4 fee structures typically include premium rates for expertise, technology investments, and brand value, while mid-tier firms balance quality and cost considerations, and local firms focus on competitive pricing with efficient service delivery that provides cost-effective audit solutions.

What Fee Calculation Methodologies Do UAE Audit Firms Employ?

UAE audit firms employ diverse fee calculation methodologies including time-based billing, fixed-fee arrangements, value-based pricing, risk-adjusted models, and hybrid approaches that balance cost predictability with service quality and profitability across different client segments and engagement types.

Time-based billing remains prevalent for complex audits with variable scope, while fixed-fee arrangements provide cost certainty for standard audits, and value-based pricing reflects audit complexity and business impact rather than pure time investment in service delivery.

Modern methodologies increasingly incorporate risk assessment factors, technology efficiency gains, and value delivery metrics that create sophisticated pricing models aligned with actual service costs and client value expectations in competitive audit markets.

How Do Time-Based vs Fixed-Fee Audit Pricing Models Compare?

| Time-Based Billing | Variable costs | High flexibility | Client bears risk | Complex, uncertain scope |

| Fixed-Fee Pricing | Predictable costs | Limited flexibility | Auditor bears risk | Standard, routine audits |

| Capped Time Billing | Cost ceiling | Moderate flexibility | Shared risk | Medium complexity |

| Value-Based Pricing | Variable costs | High flexibility | Performance-based | Strategic engagements |

| Hybrid Models | Balanced approach | Moderate flexibility | Shared allocation | Most engagements |

Pricing model selection affects cost management, budgeting accuracy, and service delivery efficiency, requiring careful consideration of audit complexity, scope certainty, and risk tolerance preferences that align with business requirements.

What Risk Assessment Factors Influence Audit Fee Calculations?

Risk assessment factors include business complexity, industry regulations, internal control quality, prior audit issues, management integrity, financial stability, and operational challenges that create risk premiums reflecting additional audit effort and professional liability considerations.

Higher risk assessments result in increased audit procedures, senior resource allocation, extended testing requirements, and enhanced documentation that drive fee increases proportional to assessed risk levels and required audit response strategies.

What Hidden Costs and Additional Services Should You Anticipate?

Hidden costs and additional services in UAE external audits include scope extensions, regulatory filing fees, management letter preparation, interim review requirements, travel expenses, technology charges, and specialized consulting that can increase total audit costs by 20-50% beyond base fee quotations.

Additional services often emerge during audit execution through identified compliance requirements, management requests, regulatory changes, or discovered issues that require expanded testing, specialized expertise, or additional documentation beyond original scope definitions and fee estimates.

Anticipating these costs through comprehensive scope definition, service clarification, and contingency budgeting prevents unexpected expenses while ensuring appropriate service delivery for complete audit requirements and regulatory compliance objectives.

What Additional Services Commonly Increase External Audit Costs?

| Management Letter | AED 5,000-25,000 | Control weaknesses | Proactive control review | Operational improvement |

| Regulatory Filings | AED 3,000-15,000 | Compliance requirements | Early planning | Compliance assurance |

| Interim Reviews | AED 10,000-50,000 | Quarterly requirements | Annual planning | Continuous monitoring |

| Tax Compliance | AED 8,000-40,000 | Tax complexity | Integrated planning | Compliance efficiency |

| IT Systems Review | AED 15,000-75,000 | Technology risks | System preparation | Risk mitigation |

| Travel Expenses | AED 2,000-20,000 | Multiple locations | Logistics optimization | Comprehensive coverage |

Understanding additional service triggers enables proactive planning and cost management while ensuring comprehensive audit coverage and regulatory compliance through strategic service integration.

How Can You Identify and Prevent Unexpected Audit Cost Escalations?

Identify cost escalations through detailed scope discussions, service clarification, assumption documentation, change order procedures, and regular communication that establishes clear boundaries and prevents scope creep during audit execution phases.

Prevention strategies include comprehensive planning, assumption validation, service definition, contingency budgeting, and milestone reviews that maintain cost control while ensuring appropriate audit response to identified issues and compliance requirements.

How Should You Approach Budget Planning and Cost Optimization for External Audits?

Budget planning for external audits requires comprehensive cost assessment, multi-year planning, contingency allocation, and optimization strategies that balance cost control with audit quality and regulatory compliance while supporting business operations and growth objectives effectively.

Effective budget planning involves analyzing historical costs, assessing scope changes, evaluating firm alternatives, negotiating service packages, and implementing cost control measures that optimize audit value while maintaining professional service quality and compliance assurance.

Cost optimization strategies include scope refinement, process improvement, technology utilization, timing optimization, and relationship management that reduce unnecessary expenses while preserving audit effectiveness and regulatory compliance requirements.

How Do You Negotiate Audit Fees Effectively While Maintaining Service Quality?

Negotiate audit fees through value demonstration, scope optimization, relationship building, competitive benchmarking, and service package structuring that achieves cost objectives while preserving audit quality and professional relationship integrity.

Effective negotiation focuses on value optimization rather than pure cost reduction, emphasizing efficiency improvements, scope refinement, timing flexibility, and multi-year agreements that benefit both parties while maintaining professional service standards and compliance assurance.

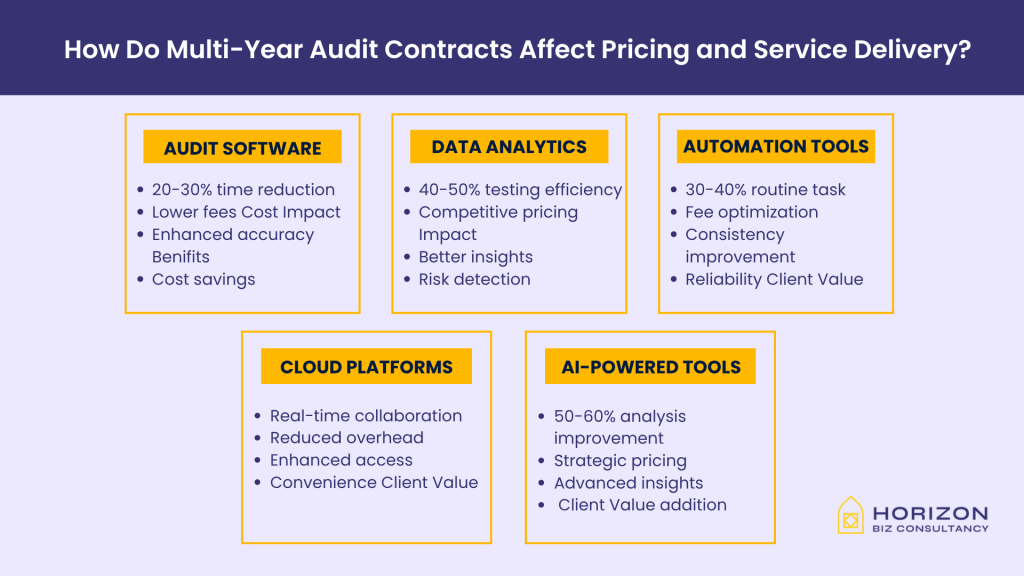

What Technology and Efficiency Factors Impact Modern Audit Pricing?

Technology and efficiency factors significantly impact modern audit pricing through automation capabilities, data analytics tools, cloud-based platforms, and digital audit procedures that reduce manual effort while enhancing audit quality and enabling competitive pricing structures across different firm categories.

Advanced audit technologies enable efficiency gains, risk assessment improvements, testing automation, and documentation streamlining that reduce audit hours while improving quality, creating cost savings that benefit clients through competitive pricing and enhanced service delivery.

Efficiency improvements through technology adoption, process optimization, and staff training create sustainable cost advantages that enable audit firms to offer competitive pricing while maintaining profitability and service quality in increasingly competitive audit markets.

How Do Technology Investments Affect Audit Pricing and Service Delivery?

Technology adoption creates win-win scenarios where audit firms achieve efficiency gains while clients benefit from competitive pricing, enhanced service quality, and improved audit insights through advanced technological capabilities.

What Efficiency Improvements Can Reduce Audit Costs Without Compromising Quality?

Efficiency improvements include process standardization, documentation optimization, client preparation enhancement, technology utilization, and team coordination that reduce audit time while maintaining or improving audit quality through systematic approach improvements.

Cost reduction strategies focus on eliminating inefficiencies, streamlining procedures, enhancing preparation, and optimizing resource allocation that achieve savings through improved productivity rather than reduced service quality or scope limitations.

How Do Industry-Specific Factors Affect External Audit Fees in the UAE?

Industry-specific factors create significant audit fee variations in the UAE through regulatory complexity, risk profiles, accounting standards, compliance requirements, and operational characteristics that require specialized expertise and additional procedures, resulting in industry premium pricing structures.

High-risk industries like banking, insurance, oil and gas, and healthcare typically command premium fees due to complex regulations, specialized standards, enhanced procedures, and regulatory scrutiny that require extensive expertise and additional audit effort beyond standard commercial audits.

Industry factors include regulatory requirements, technical complexity, risk assessment demands, specialist knowledge needs, and compliance obligations that create cost differentials ranging from 10-100% above standard audit fees depending on sector-specific requirements and complexity levels.

How Can Industry-Specific Businesses Optimize Audit Costs While Meeting Regulatory Requirements?

Industry-specific optimization involves leveraging sector expertise, streamlining compliance processes, implementing internal controls, utilizing technology solutions, and building efficient audit relationships that reduce costs while ensuring comprehensive regulatory compliance and audit quality.

Optimization strategies include industry specialist selection, process improvement, control enhancement, documentation efficiency, and regulatory alignment that achieve cost savings while maintaining audit effectiveness and compliance assurance within industry-specific requirements.

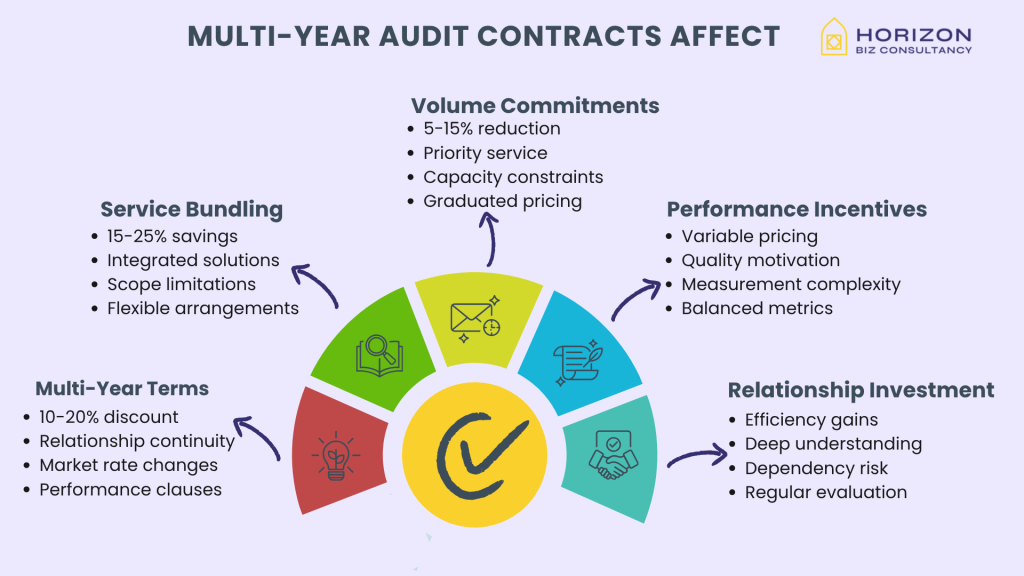

What Multi-Year Contract and Relationship Factors Influence Audit Pricing?

Multi-year contract and relationship factors significantly influence audit pricing through volume discounts, relationship premiums, efficiency improvements, knowledge retention, and strategic partnerships that create cost advantages and pricing stability for long-term audit engagements and professional relationships.

Long-term relationships enable efficiency gains through business understanding, process familiarity, risk assessment refinement, and streamlined procedures that reduce audit time and costs while improving service quality and value delivery over extended engagement periods.

Contract structures including multi-year agreements, service bundling, performance incentives, and relationship terms create pricing advantages that benefit both audit firms and clients through reduced costs, enhanced efficiency, and improved service delivery consistency.

How Do Multi-Year Audit Contracts Affect Pricing and Service Delivery?

| Multi-Year Terms | 10-20% discount | Relationship continuity | Market rate changes | Performance clauses |

| Service Bundling | 15-25% savings | Integrated solutions | Scope limitations | Flexible arrangements |

| Volume Commitments | 5-15% reduction | Priority service | Capacity constraints | Graduated pricing |

| Performance Incentives | Variable pricing | Quality motivation | Measurement complexity | Balanced metrics |

| Relationship Investment | Efficiency gains | Deep understanding | Dependency risk | Regular evaluation |

Multi-year arrangements create mutual benefits through cost savings, service improvements, and relationship development while requiring careful structure to maintain flexibility and performance accountability.

What Relationship Management Strategies Optimize Long-Term Audit Costs?

Relationship management strategies include regular communication, performance feedback, process improvement collaboration, strategic planning alignment, and mutual investment that strengthen partnerships while achieving cost optimization through efficiency gains and value enhancement.

Effective relationship management focuses on value creation, continuous improvement, transparent communication, and aligned objectives that build productive partnerships yielding cost benefits, service improvements, and strategic value over extended engagement periods.

How Do You Evaluate Audit Fee Proposals and Make Cost-Effective Decisions?

Evaluating audit fee proposals requires comprehensive analysis that considers total cost, service scope, value proposition, firm capabilities, and relationship factors rather than focusing solely on base fees, ensuring optimal decision making that balances cost and quality considerations effectively.

Proposal evaluation involves comparing service scope, analyzing cost components, assessing value delivery, evaluating firm credentials, and considering relationship factors that determine total engagement value beyond simple fee comparisons and price-based selection criteria.

Cost-effective decisions require balancing immediate cost savings with long-term value, service quality, relationship benefits, and strategic alignment that optimize total audit value while meeting budgetary constraints and compliance requirements through informed selection processes.

How Do You Implement Ongoing Cost Management for External Audit Engagements?

Implement ongoing cost management through regular monitoring, performance measurement, scope control, efficiency tracking, and relationship review that maintains cost discipline while ensuring audit quality and value delivery throughout engagement periods.

Cost management strategies include milestone reviews, variance analysis, scope change control, efficiency improvement initiatives, and performance feedback that optimize costs while preserving audit effectiveness and professional relationship quality.

Conclusion

Understanding external audit fees in the UAE requires comprehensive knowledge of cost structures, calculation methodologies, hidden costs, and optimization strategies that enable effective budget planning and cost management while ensuring audit quality and regulatory compliance. Successful cost management balances immediate expense control with long-term value optimization through strategic planning and informed decision making.

Businesses that invest in understanding audit cost structures, implementing effective budget planning, and building productive audit relationships position themselves for cost-effective compliance while maximizing audit value. The key lies in comprehensive evaluation, strategic planning, and ongoing management that optimizes costs without compromising audit quality or regulatory requirements.

FAQ’s

Small businesses (revenue under AED 5M) typically pay AED 15,000-50,000, while medium businesses (AED 5-50M revenue) pay AED 30,000-150,000. Fees depend on complexity, industry, scope, and firm category.

Ask about total cost breakdown, included services, additional service rates, scope assumptions, change order procedures, timeline commitments, team composition, and value-added services.

Structure multi-year contracts with 10-20% discounts, performance clauses, scope flexibility, and regular review mechanisms.

Business size (revenue) and complexity level have the highest impact, potentially increasing fees by 200-400%.

Reduce costs through better preparation, efficient documentation, internal control improvements, scope optimization, multi-year contracts, and technology utilization.