A Tax Residency Certificate (TRC) is an important document for expatriates and companies operating in the UAE. It confirms your tax domicile is in the UAE and helps avoid double taxation. This step-by-step guide explains everything about getting a TRC in the UAE.

Who Needs a Tax Residency Certificate in the UAE

- You have lived in the UAE for over 6 months in a financial year. Just having a UAE residence visa does not make you eligible.

- You have any source of income from outside the UAE. With a TRC, you avoid double taxation.

- You own assets or property in the UAE. A TRC facilitates opening local bank accounts to transfer funds.

- Your home country has special tax regulations requiring submission of a Tax Residency Certificate.

In summary, having a UAE TRC gives major benefits like avoiding double taxation, smooth banking, visas, loans, and purchases.

Eligibility Criteria for Getting a UAE Tax Residency Certificate

The eligibility criteria is different for individuals and companies when applying for a UAE Tax Residency Certificate.

For Individuals

To be eligible for a UAE TRC as an individual, you must:

- Have lived in the UAE for at least 180 days in the year

- Have an annual residential lease contract registered in the UAE

This means you cannot just visit the UAE. You need to show you ordinarily reside here with a long-term visa and housing contract.

For Companies

- Be established in the UAE for at least one financial year

- Have audited financial accounts prepared by an accredited audit firm in the UAE

Additionally, offshore companies not listed in any Double Taxation Avoidance Agreements cannot apply for a UAE TRC.

Step-by-Step Guide for Applying for a UAE Tax Residency Certificate

Follow these key steps to apply

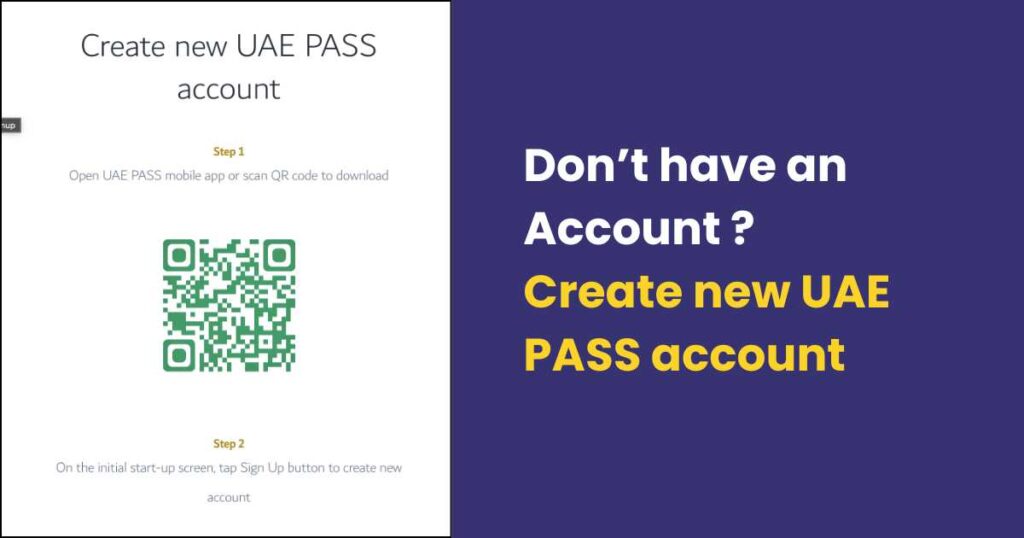

Step 1: Create an Account on the e-TRC Portal

First, you need to visit the e-TRC portal and create an account. This is where you will submit all TRC applications and track their status.

Step 2: Fill the Online TRC Application Form

Once logged in, fill the Tax Residency Certificate online application form. You need to choose if you are an individual or company and select the country.

Step 3: Prepare and Upload All Required Documents

There is a defined list of documents required for TRC application:

- For individuals: passport, visa, Emirates ID, lease contract, income proofs, bank statements etc.

- For companies: trade license, establishment contract, owners’ documents, audited financial reports etc.

**Scan and upload clear copies of all documents on the portal.

Step 4: Pay the TRC Application Fees

You need to pay AED 100 as TRC application fees on the portal via the integrated payment gateway. Keep the receipt for future reference.

Step 5: Track Application Status

- Your TRC application will now be processed by the Federal Tax Authority within 4-8 weeks.

- Log in to your e-TRC account regularly to track updates on whether your TRC has been approved, rejected or additional documents are needed.

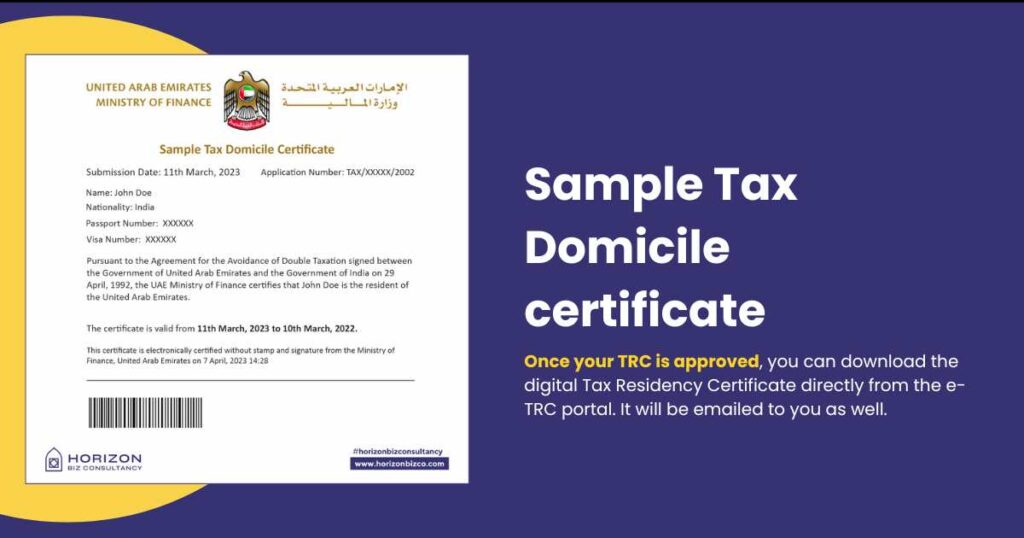

Step 6: Download Your UAE Tax Residency Certificate

Once your TRC is approved, you can download the digital Tax Residency Certificate directly from the e-TRC portal. It will be emailed to you as well.

Renewing Your UAE Tax Residency Certificate

The Certificate issued in the UAE is valid for one year from date of issue.

To renew it, log back in to your e-TRC account and reapply within 60 days of expiry by submitting your updated documents. The renewal process also takes around 4-8 weeks.

Major Benefits of Having a Tax Residency Certificate in the UAE

- Avoid Double Taxation: With a TRC you only need to pay taxes in one country – the UAE.

- Open Bank Accounts Smoothly: UAE banks often need a TRC when you have overseas income.

- Apply for Visas and Schools Easily: A TRC proves your resident status.

- Purchase Assets and Property: The TRC helps source funds from abroad.

- Access Loans and Credit Cards: It shows your financial eligibility.

Conclusion

A Tax Residency Certificate offers major financial and lifestyle conveniences in the UAE. All expats and locally registered companies should apply for it.

With this detailed 4-step guide, you can now easily navigate the e-TRC portal and submit your documents to obtain a UAE TRC.

Contact us if you need any assistance with getting a Tax Residency Certificate in the UAE. Our tax consultants are always happy to help!

FAQ’s

It costs AED 100 to apply for a one year UAE TRC. Additional fees for downloading the certificate may apply.

Yes, you can email information@tax.gov.ae with your application number to get an update.

No. TRC eligibility depends solely on your individual resident status or company’s incorporation status in UAE.

No. The UAE Tax Residency Certificate proves your tax domicile is only the UAE, not any other country.