The introduction of UAE Corporate Tax has fundamentally transformed external audit requirements, creating new verification obligations, expanded audit scope, and complex coordination requirements that many businesses are still learning to navigate. Business owners frequently wonder: “How has Corporate Tax changed what my external auditor needs to review, and what new procedures should I expect?”

Corporate Tax implementation has added significant complexity to external audit processes, requiring auditors to verify tax provisions, assess deferred tax calculations, review transfer pricing positions, and coordinate audit findings with corporate tax return preparation in ways that didn’t exist before 2023.

Understanding these new audit requirements helps businesses prepare for expanded audit scope, budget for increased audit costs, and ensure proper coordination between audit processes and corporate tax compliance to meet both regulatory frameworks effectively.

How Has UAE Corporate Tax Changed External Audit Requirements?

UAE Corporate Tax has fundamentally altered external audit requirements by introducing tax accounting complexities, creating new audit verification obligations, and requiring auditors to assess corporate tax compliance aspects that significantly expand traditional audit scope and procedures.

The changes include mandatory verification of tax provisions, assessment of deferred tax calculations, review of tax position documentation, and evaluation of corporate tax compliance systems that auditors must now address as part of standard external audit procedures.

These expanded requirements affect audit planning, resource allocation, professional expertise needs, and audit timelines, as auditors must now possess corporate tax knowledge and implement procedures that verify both financial statement accuracy and tax compliance adequacy.

What New Audit Procedures Has Corporate Tax Introduced?

| Current Tax Provisions | Tax liability accuracy | Calculation verification | Tax computations, legislation |

| Deferred Tax Assets/Liabilities | Future tax impact assessment | Timing difference analysis | Tax reconciliations, projections |

| Transfer Pricing Positions | Arm’s length compliance | Documentation review | TP studies, benchmarking |

| Tax Accounting Policies | Compliance with tax law | Policy assessment | Accounting manuals, procedures |

| Tax System Controls | Internal control evaluation | Control testing | System documentation, procedures |

These new procedures require enhanced audit expertise, additional testing, and comprehensive documentation review that significantly expands audit scope beyond traditional financial statement verification.

How Do Corporate Tax Requirements Affect Audit Planning and Resource Allocation?

Corporate Tax requirements affect audit planning through increased time allocation for tax-related procedures, enhanced professional expertise requirements, and expanded audit scope that requires additional audit hours and specialized knowledge.

Planning considerations include tax expertise availability, coordination with tax advisors, documentation review requirements, and timeline management that accommodates both audit completion and corporate tax filing coordination needs.

What Tax Provisions and Deferred Tax Auditing Procedures Are Required?

Tax provisions and deferred tax auditing requires comprehensive verification of current tax calculations, assessment of deferred tax positions, and evaluation of tax accounting methodologies that ensure financial statement accuracy and compliance with UAE Corporate Tax requirements.

Current tax provision auditing involves verifying tax calculations, assessing provision adequacy, reviewing supporting documentation, and evaluating tax position accuracy that supports proper financial statement presentation and regulatory compliance.

Deferred tax auditing requires analysis of timing differences, assessment of recognition criteria, evaluation of measurement accuracy, and review of future tax impact calculations that properly reflect corporate tax implications in financial statements.

How Do Auditors Verify Current Tax Provision Accuracy?

| Taxable Income Calculation | Reconciliation review | Financial statements, adjustments | Book-tax differences |

| Tax Rate Application | Rate verification | Tax legislation, rates | Rate changes, exemptions |

| Payment Timing | Cash flow analysis | Payment schedules, deadlines | Installment calculations |

| Penalty Provisions | Compliance assessment | Deadline tracking, penalties | Late filing risks |

| Credit Utilization | Credit verification | Available credits, usage | Foreign tax credits |

Comprehensive verification ensures tax provision accuracy while identifying potential compliance issues that could affect both audit opinions and corporate tax filing accuracy.

What Deferred Tax Complexities Must Auditors Address?

Deferred tax complexities include temporary difference identification, recognition criteria assessment, measurement accuracy verification, and future tax rate considerations that require specialized knowledge and comprehensive analysis.

Auditors must evaluate timing difference calculations, assess probability of reversal, verify tax rate applications, and review management assumptions that support deferred tax position accuracy and financial statement compliance.

How Is Transfer Pricing Documentation Reviewed During External Audits?

Transfer pricing documentation review during external audits involves verifying arm’s length pricing compliance, assessing documentation adequacy, evaluating economic analysis quality, and ensuring transfer pricing positions support both audit conclusions and corporate tax filing accuracy.

The review process includes assessment of transfer pricing studies, verification of benchmarking analyses, evaluation of pricing methodologies, and coordination between transfer pricing positions and financial statement presentations that ensure consistency across compliance requirements.

Auditors must understand transfer pricing regulations, assess documentation quality, evaluate economic analysis, and verify that transfer pricing positions properly support corporate tax calculations and audit conclusions.

What Transfer Pricing Elements Must Auditors Verify During External Audits?

| Economic Analysis | Methodology review | Technical accuracy | Tax calculation support |

| Benchmarking Studies | Data verification | Market comparability | Audit evidence standards |

| Pricing Policies | Implementation testing | Operational compliance | Financial statement consistency |

| Documentation Quality | Completeness assessment | Regulatory standards | Audit trail requirements |

| Related Party Transactions | Transaction verification | Arm’s length testing | Corporate tax implications |

Comprehensive verification ensures transfer pricing positions support both audit conclusions and corporate tax compliance while meeting professional auditing standards for evidence quality and reliability.

How Do Auditors Coordinate Transfer Pricing Reviews with Corporate Tax Compliance?

Auditors coordinate transfer pricing reviews with corporate tax compliance through integrated analysis, consistent position development, and unified evidence gathering that ensures transfer pricing conclusions support corporate tax calculations and audit findings.

Coordination requires understanding both transfer pricing regulations and corporate tax requirements, implementing integrated testing procedures, and ensuring consistent professional conclusions across both compliance areas.

What Coordination Is Required Between Corporate Tax Returns and External Audits?

Coordination between corporate tax returns and external audits requires aligned timing, consistent positions, shared information, and unified professional oversight that ensures audit findings support corporate tax filing positions while maintaining audit independence and quality.

The coordination involves synchronized planning, information sharing protocols, consistent professional analysis, and timeline management that optimizes both audit completion and corporate tax filing preparation through integrated service delivery.

Successful coordination reduces duplication, improves compliance quality, ensures position consistency, and optimizes professional service costs while meeting both audit standards and corporate tax compliance requirements effectively.

How Should Audit and Corporate Tax Filing Timelines Be Coordinated?

| Year-End Procedures | December 31 closure | Tax year determination | Aligned accounting periods |

| Audit Completion | 6 months from year-end | Tax return preparation | March-April audit completion |

| Tax Return Filing | Audit opinion issuance | 9 months deadline | Coordinated professional delivery |

| Information Exchange | Audit evidence gathering | Tax position documentation | Shared documentation systems |

Effective coordination ensures audit completion supports corporate tax filing while meeting both regulatory deadlines through integrated professional service delivery and timeline management.

What Information Must Be Shared Between Audit and Tax Return Preparation?

Information sharing includes financial statement data, audit adjustments, tax calculation support, and professional analysis that ensures consistency between audit conclusions and corporate tax filing positions.

This coordination requires establishing information sharing protocols, maintaining confidentiality standards, ensuring professional independence, and coordinating analysis that supports both audit quality and tax compliance accuracy.

How Do Corporate Tax System Controls Affect External Audit Procedures?

Corporate Tax system controls significantly affect external audit procedures by requiring auditors to evaluate tax compliance systems, assess control effectiveness, and verify tax process adequacy that ensures accurate corporate tax calculations and compliance.

Control evaluation includes assessment of tax calculation systems, review of approval processes, evaluation of segregation of duties, and testing of automated controls that support accurate corporate tax compliance and financial reporting.

Auditors must understand corporate tax requirements, evaluate control design effectiveness, test control operating effectiveness, and assess system reliability that supports both audit conclusions and corporate tax compliance quality.

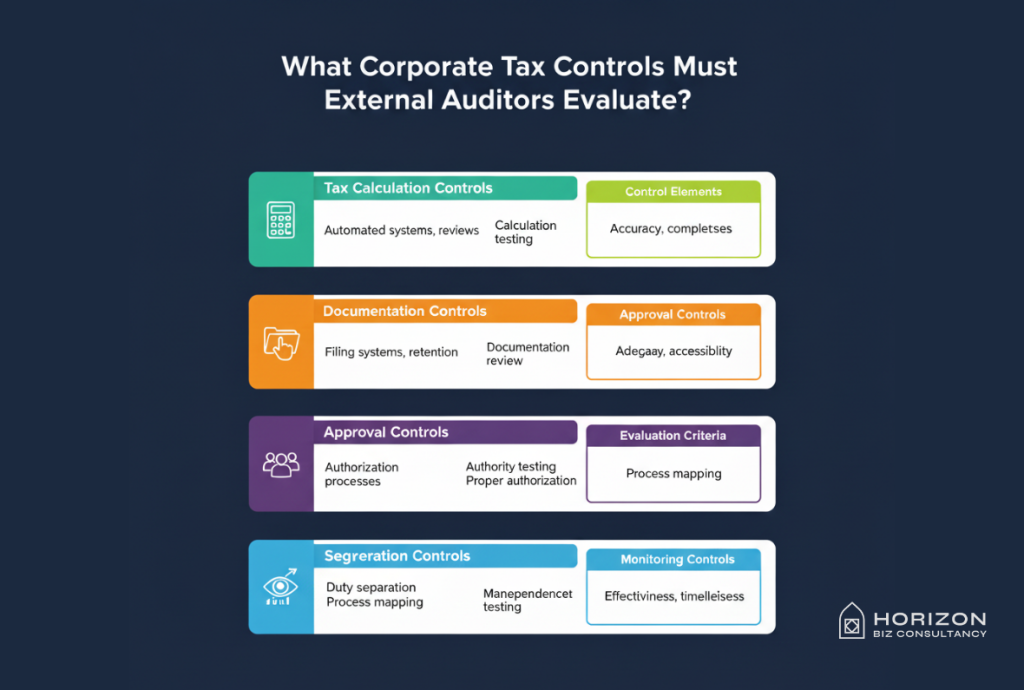

What Corporate Tax Controls Must External Auditors Evaluate?

| Tax Calculation Controls | Automated systems, reviews | Calculation testing | Accuracy, completeness |

| Documentation Controls | Filing systems, retention | Documentation review | Adequacy, accessibility |

| Approval Controls | Authorization processes | Authority testing | Proper authorization |

| Segregation Controls | Duty separation | Process mapping | Independence, oversight |

| Monitoring Controls | Review processes | Management testing | Effectiveness, timeliness |

Comprehensive control evaluation ensures corporate tax compliance quality while supporting audit conclusions regarding internal control effectiveness and financial statement reliability.

How Do Tax System Control Deficiencies Affect Audit Opinions?

Tax system control deficiencies can affect audit opinions through increased testing requirements, potential material weaknesses identification, and enhanced disclosure requirements that impact audit conclusions and financial statement presentations.

Deficiency assessment requires evaluating severity, assessing financial statement impact, determining remediation requirements, and coordinating management responses that address control weaknesses while maintaining audit quality.

What Additional Professional Expertise Is Required for Corporate Tax Auditing?

Corporate Tax auditing requires enhanced professional expertise combining traditional audit skills with specialized corporate tax knowledge, transfer pricing understanding, and UAE regulatory expertise that enables effective audit execution under expanded requirements.

Professional expertise requirements include corporate tax legislation knowledge, tax accounting standards understanding, transfer pricing regulations familiarity, and audit methodology adaptation that addresses new compliance complexities effectively.

The enhanced expertise requirements affect auditor selection, training needs, service delivery costs, and audit quality considerations that businesses must evaluate when selecting audit professionals for corporate tax-era compliance.

What Specialized Knowledge Must Corporate Tax-Era Auditors Possess?

| UAE Corporate Tax Law | Legislative understanding | Tax provision auditing | Technical qualification testing |

| Tax Accounting Standards | IFRS tax requirements | Financial statement preparation | Professional certification |

| Transfer Pricing Regulations | TP methodology knowledge | Related party auditing | Specialized training verification |

| Tax System Technology | System understanding | Control evaluation | Technical competency assessment |

Comprehensive expertise ensures audit quality while addressing corporate tax complexities through qualified professional service delivery that meets both audit standards and tax compliance requirements.

How Do You Select Qualified Auditors for Corporate Tax-Era Requirements?

Select qualified auditors through credential verification, expertise assessment, experience evaluation, and competency testing that demonstrates capability in both traditional auditing and corporate tax-related audit procedures.

Selection criteria should emphasize corporate tax knowledge, integrated service experience, professional qualifications, and demonstrated success with expanded audit scope that addresses both audit quality and tax compliance verification needs.

Conclusion

UAE Corporate Tax has fundamentally transformed external audit requirements through expanded scope, new verification procedures, and enhanced coordination requirements that significantly impact audit planning, execution, and professional expertise needs. Understanding these changes enables businesses to prepare for increased audit complexity while ensuring proper coordination between audit processes and corporate tax compliance.

The integration of corporate tax considerations into external audit procedures creates opportunities for improved compliance quality through coordinated professional services while requiring enhanced expertise and expanded audit scope. Businesses that understand and adapt to these new requirements position themselves for successful compliance while optimizing professional service delivery across both audit and tax requirements through integrated approaches.

FAQ’s

Yes, integrated service providers can handle both external audit and corporate tax compliance, offering coordination benefits, consistent positions, cost efficiencies.

Implement tax calculation controls, documentation systems, approval processes, segregation of duties, and monitoring procedures that ensure accurate corporate tax compliance while supporting external audit requirements.

Auditors verify transfer pricing through documentation review, economic analysis assessment, benchmarking study evaluation, pricing methodology testing, and coordination with corporate tax calculations.

Audit completion should occur by March-April to support corporate tax return preparation for the September deadline, requiring coordinated planning that ensures audit findings support tax calculations while meeting both compliance calendars through integrated professional service delivery.