Understanding UAE external audit timelines and critical deadlines has become essential for business compliance as regulatory requirements create interconnected filing obligations with strict deadlines that can trigger significant penalties if missed. Many business owners ask: “When exactly must I complete my external audit, and how do all these different regulatory deadlines connect?”

The UAE external audit timeline involves multiple regulatory authorities with overlapping deadlines including Ministry of Economy (MOE) submissions, Annual General Meeting (AGM) requirements, Federal Tax Authority (FTA) coordination, and various other compliance obligations that must be carefully coordinated to avoid penalties and ensure comprehensive regulatory adherence.

This comprehensive timeline guide helps businesses understand all critical audit deadlines, plan compliance activities effectively, and coordinate multiple regulatory requirements to ensure timely completion while avoiding costly penalties and regulatory complications.

What Are the Core UAE External Audit Timeline Requirements?

Core UAE external audit timeline requirements center around the fundamental obligation to complete external audits within six months of the financial year-end, but this basic requirement connects to multiple regulatory deadlines that create complex compliance calendars requiring careful coordination.

The timeline includes audit initiation requirements, completion deadlines, filing obligations, and coordination requirements across multiple regulatory authorities that each impose specific timing requirements for different aspects of audit-related compliance.

Understanding these core requirements provides the foundation for comprehensive compliance planning that ensures all deadlines are met while optimizing audit efficiency and regulatory coordination across the complex UAE business compliance landscape.

What Are the Fundamental External Audit Timeline Milestones?

| Audit Commencement | Within 3 months of year-end | Internal planning | Compressed timeline pressure |

| Audit Completion | Within 6 months of year-end | MOE requirement | Penalties, regulatory sanctions |

| AGM Holding | Within 4 months of year-end | Commercial Companies Law | Legal non-compliance |

| MOE Filing | Within 6 months of year-end | Ministry of Economy | Administrative penalties |

| Tax Return Filing | Within 9 months of year-end | Federal Tax Authority | Tax penalties, interest |

These fundamental milestones create the framework for comprehensive compliance planning while establishing critical checkpoints that ensure timely completion of all regulatory requirements.

How Do Financial Year-End Dates Affect Audit Timeline Planning?

Financial year-end dates significantly impact audit timeline planning by determining all subsequent deadline calculations, affecting auditor availability during peak seasons, and influencing coordination requirements with other businesses sharing similar year-ends.

Year-end selection affects audit scheduling, professional service availability, cost considerations, and regulatory coordination timing that businesses must consider when planning comprehensive compliance strategies and audit timeline management.

How Do AGM Requirements Coordinate with External Audit Completion?

Annual General Meeting (AGM) requirements create critical coordination points with external audit completion as audited financial statements must typically be available before AGM meetings, requiring careful timeline planning to ensure audit completion supports AGM scheduling requirements.

AGM coordination involves ensuring audit completion precedes meeting scheduling, providing adequate time for shareholder document preparation, and coordinating audit findings with AGM presentation requirements that demonstrate proper corporate governance and regulatory compliance.

The coordination becomes particularly complex for businesses with multiple stakeholder groups, international shareholders, or complex audit requirements that may extend audit timelines while maintaining AGM deadline compliance obligations.

What AGM Timeline Requirements Must Be Coordinated with External Audits?

| Audit Report Availability | 21 days before AGM | Audit completion required | Early audit planning |

| Financial Statement Distribution | 21 days before AGM | Audited statements needed | Document preparation time |

| AGM Scheduling | Within 4 months year-end | Post-audit completion | Venue, shareholder coordination |

| Shareholder Notice | 21 days minimum | Final audit adjustments | Communication planning |

| Resolution Preparation | Before AGM date | Audit findings incorporation | Legal documentation |

Effective coordination ensures AGM compliance while providing adequate time for audit completion and proper shareholder communication through integrated timeline planning.

How Do You Schedule AGMs to Accommodate Audit Completion Requirements?

Schedule AGMs by working backward from regulatory deadlines, allowing adequate time for audit completion, providing buffer periods for audit adjustments, and ensuring proper shareholder notification periods that accommodate potential audit timeline extensions.

Effective scheduling requires early audit engagement, realistic timeline estimation, contingency planning for audit complications, and flexible AGM arrangements that can accommodate audit completion variations while maintaining regulatory compliance.

What Ministry of Economy (MOE) Submission Requirements Affect Audit Timelines?

Ministry of Economy submission requirements create specific deadline obligations for audited financial statement filing that must be coordinated with audit completion timelines to ensure regulatory compliance while avoiding administrative penalties and sanctions.

MOE submission requirements include specific document formats, filing procedures, timing requirements, and coordination with other regulatory filings that businesses must understand and plan for when establishing audit timelines and compliance calendars.

The submissions involve audited financial statements, audit reports, corporate governance documentation, and various other requirements that must be properly prepared and submitted within specified timeframes following audit completion.

What Specific MOE Filing Requirements Must Be Coordinated with External Audits?

| Audited Financial Statements | Complete financial statements | Within 6 months | Audit completion first |

| Independent Auditor Report | Signed audit opinion | With financial statements | Auditor coordination |

| Corporate Governance Report | Governance compliance | Annual submission | Audit committee coordination |

| Shareholding Information | Ownership structure | With annual filing | Legal documentation |

| Management Report | Business overview | Annual requirement | Management preparation |

Comprehensive filing coordination ensures MOE compliance while maintaining proper documentation standards and regulatory deadline adherence through integrated compliance planning.

How Do MOE Penalties for Late Filing Affect Audit Timeline Planning?

MOE penalties for late filing create significant financial consequences that require businesses to prioritize audit completion and filing coordination to avoid administrative sanctions, regulatory complications, and potential business operation restrictions.

Understanding penalty structures helps businesses allocate appropriate resources for timely audit completion while implementing contingency planning that addresses potential timeline complications without risking regulatory non-compliance.

How Does FTA Coordination Impact External Audit Scheduling?

Federal Tax Authority (FTA) coordination significantly impacts external audit scheduling through corporate tax filing requirements, transfer pricing obligations, and economic substance compliance that must be coordinated with audit timelines to ensure comprehensive regulatory adherence.

FTA coordination involves aligning audit completion with corporate tax return preparation, ensuring audit findings support tax positions, and coordinating multiple compliance requirements that optimize professional service delivery while meeting all regulatory deadlines.

The coordination becomes particularly important for businesses with complex tax positions, transfer pricing obligations, or economic substance requirements that require integrated compliance approaches and coordinated professional service delivery.

What FTA Requirements Must Be Coordinated with External Audit Timelines?

| Corporate Tax Return | 9 months from year-end | Audit completion first | Tax position support |

| Transfer Pricing Documentation | With tax return | Audit review required | Professional coordination |

| Economic Substance Report | 6 months from notification | Audit evidence needed | Compliance verification |

| VAT Return Coordination | Quarterly filing | Ongoing coordination | System integration |

| Tax Provision Verification | During audit | Integrated procedures | Professional expertise |

Effective FTA coordination ensures comprehensive tax compliance while optimizing audit efficiency through integrated professional service delivery and coordinated compliance planning.

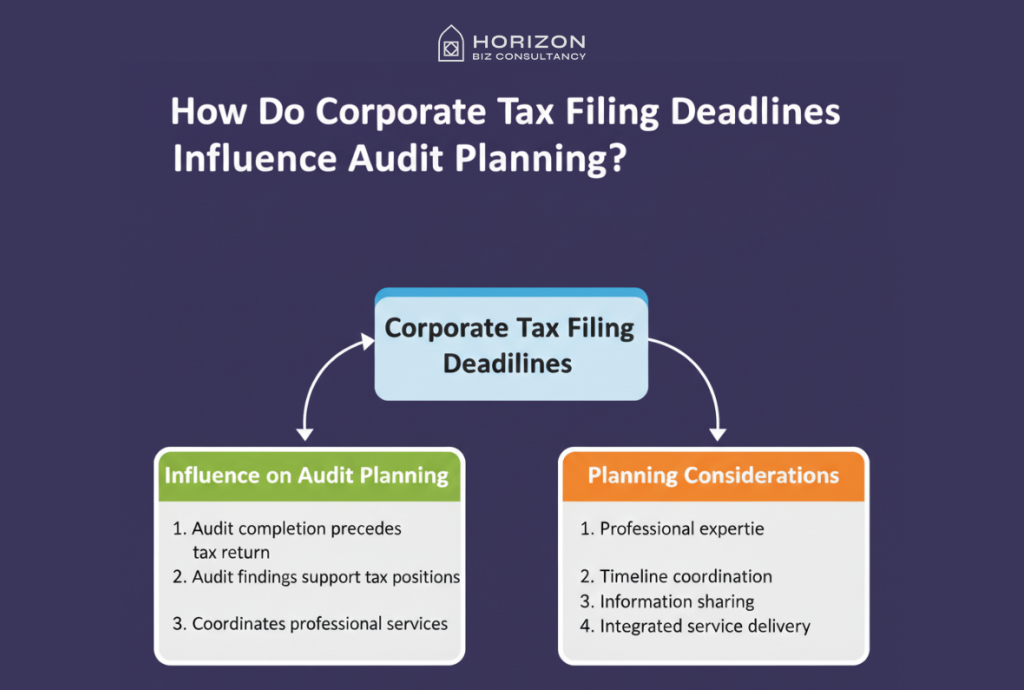

How Do Corporate Tax Filing Deadlines Influence Audit Planning?

Corporate tax filing deadlines influence audit planning by requiring audit completion to precede tax return preparation, ensuring audit findings support tax positions, and coordinating professional services that address both audit and tax compliance efficiently.

Planning considerations include professional expertise requirements, timeline coordination, information sharing protocols, and integrated service delivery that optimizes compliance outcomes while meeting all regulatory deadlines effectively.

What Other Regulatory Coordination Requirements Affect Audit Timelines?

Other regulatory coordination requirements affecting audit timelines include free zone authority obligations, sector-specific regulatory requirements, international compliance coordination, and various licensing authority requirements that create additional deadline pressures and coordination needs.

These requirements vary significantly based on business structure, industry sector, geographic presence, and regulatory status, creating customized compliance calendars that require careful planning and professional coordination to ensure comprehensive adherence.

Understanding all applicable regulatory requirements enables businesses to develop realistic audit timelines while ensuring coordination across multiple compliance obligations that affect business operations and regulatory standing.

What Additional Regulatory Requirements Must Be Coordinated with External Audits?

| Free Zone Authorities | Zone-specific filings | Variable deadlines | Authority coordination |

| Central Bank (Financial Sector) | Prudential reporting | Quarterly/Annual | Regulatory expertise |

| Securities & Commodities Authority | Public company requirements | Strict deadlines | Market compliance |

| Professional Licensing | Industry-specific requirements | Annual renewals | License maintenance |

| International Regulators | Cross-border compliance | Multiple jurisdictions | Global coordination |

Comprehensive regulatory coordination ensures complete compliance while avoiding conflicts between different authority requirements through integrated planning and professional coordination.

How Do You Manage Multiple Regulatory Deadlines Simultaneously?

Manage multiple regulatory deadlines through integrated compliance calendars, coordinated professional services, systematic tracking systems, and proactive planning that addresses all requirements while optimizing resource allocation and timeline efficiency.

Effective management requires understanding all applicable requirements, establishing coordination protocols, implementing tracking systems, and maintaining professional relationships that support comprehensive compliance across multiple regulatory frameworks.

What Contingency Planning Is Required for Audit Timeline Management?

Contingency planning for audit timeline management involves identifying potential delays, establishing alternative scenarios, implementing buffer periods, and creating response protocols that address timeline complications while maintaining regulatory compliance and business continuity.

Effective contingency planning considers audit complexity factors, seasonal capacity constraints, potential technical complications, and regulatory coordination challenges that could impact timeline adherence and require alternative approaches or accelerated procedures.

The planning process involves risk assessment, scenario development, resource allocation alternatives, and communication protocols that enable rapid response to timeline challenges while protecting business interests and regulatory compliance.

What Common Timeline Risks Require Contingency Planning?

| Audit Complexity | Extended procedures | Additional resources | Early complexity assessment |

| Documentation Issues | Delayed completion | Rapid remediation | Ongoing preparation |

| Auditor Availability | Scheduling conflicts | Alternative arrangements | Early engagement |

| Technical Complications | Extended analysis | Specialized expertise | Proactive identification |

| Regulatory Changes | New requirements | Rapid adaptation | Regulatory monitoring |

Comprehensive contingency planning addresses potential timeline risks while maintaining compliance quality and regulatory adherence through proactive risk management and response preparation.

How Do You Implement Effective Audit Timeline Buffer Periods?

Implement effective buffer periods through realistic timeline estimation, early audit commencement, staged completion milestones, and flexible scheduling that accommodates potential complications while ensuring regulatory deadline compliance.

Buffer implementation requires understanding audit complexity, establishing intermediate checkpoints, maintaining professional flexibility, and creating adjustment mechanisms that address timeline variations without compromising audit quality or regulatory compliance.

How Do You Optimize Audit Timeline Coordination for Cost Efficiency?

Optimizing audit timeline coordination for cost efficiency involves strategic planning, integrated service delivery, early professional engagement, and systematic approach development that minimizes costs while ensuring comprehensive regulatory compliance and audit quality.

Cost optimization strategies include coordinated professional services, efficient resource allocation, streamlined procedures, and integrated compliance approaches that reduce duplication while maintaining quality standards across multiple regulatory requirements.

Effective optimization requires understanding cost drivers, implementing coordination strategies, leveraging professional relationships, and developing systematic approaches that achieve compliance objectives while minimizing total professional service costs.

What Timeline Optimization Strategies Reduce Overall Audit Costs?

| Early Engagement | 15-25% savings | January-February start | Adequate planning time |

| Integrated Services | 20-30% savings | Single provider coordination | Service capability assessment |

| Staged Procedures | 10-20% savings | Progressive completion | Quality checkpoint maintenance |

| Documentation Preparation | 15-25% savings | Advance organization | Audit-ready systems |

| Regulatory Coordination | 10-15% savings | Unified compliance approach | Professional coordination |

Strategic optimization achieves cost efficiency while maintaining audit quality and regulatory compliance through coordinated planning and professional service integration.

How Do You Balance Timeline Efficiency with Audit Quality Requirements?

Balance timeline efficiency with audit quality through structured planning, professional expertise optimization, systematic procedure implementation, and quality control frameworks that ensure comprehensive audit coverage while meeting timeline objectives.

Effective balancing requires understanding audit standards, implementing efficient procedures, maintaining quality checkpoints, and ensuring professional competency that supports both timeline adherence and audit excellence through coordinated service delivery.

Conclusion

UAE external audit timelines create complex coordination requirements across multiple regulatory authorities with interconnected deadlines that demand comprehensive planning and professional coordination to ensure compliance while optimizing efficiency. Understanding these timelines enables businesses to plan effectively, avoid penalties, and coordinate multiple compliance obligations through systematic approaches that protect business interests while meeting regulatory expectations.

Successful timeline management requires early planning, professional coordination, contingency preparation, and integrated compliance approaches that address all regulatory requirements while optimizing costs and maintaining audit quality. Businesses that master audit timeline coordination position themselves for sustainable compliance while minimizing regulatory risks and professional service costs through comprehensive planning and execution strategies.

FAQ’s

Select audit timing through early engagement, alternative year-end consideration, advance planning coordination, and professional capacity assessment.

Beyond MOE, coordinate with FTA corporate tax deadlines, economic substance reporting, free zone authority requirements, sector-specific regulatory filings.

Optimize costs through early professional engagement, integrated service coordination, advance documentation preparation, systematic planning approaches.

Implement contingency planning through early audit engagement, realistic timeline estimation, buffer period establishment, alternative resource arrangements, and coordinated professional services that can address complications while maintaining regulatory deadline compliance.