The UAE’s announcement of mandatory e-invoicing implementation starting July 2026 has left many businesses wondering about the significant changes ahead. Business owners across the UAE are asking: “What exactly does this new e-invoicing requirement mean for my business, and how do I prepare for the transition from traditional paper invoicing?”

The Federal Tax Authority (FTA) has introduced comprehensive e-invoicing regulations that will fundamentally transform how all B2B and B2G transactions are processed, documented, and reported in the UAE. This digital transformation represents one of the most significant changes to UAE’s tax compliance landscape since the introduction of VAT.

Understanding these new e-invoicing requirements is crucial for businesses to ensure seamless compliance, avoid penalties, and leverage the benefits of digital transformation while meeting all regulatory obligations effectively.

What Are the New E-Invoicing Requirements in UAE?

UAE’s new e-invoicing requirements mandate that all business-to-business (B2B) and business-to-government (B2G) transactions must be conducted through digital invoice formats that comply with FTA specifications. This represents a complete shift from traditional paper-based invoicing systems to structured digital documentation.

The requirements encompass mandatory digital invoice generation, real-time data transmission to FTA systems, and standardized electronic formats that ensure data integrity and regulatory compliance. These changes affect invoice creation, storage, transmission, and reporting processes across all qualifying business transactions.

What Digital Invoice Format Standards Must Businesses Follow?

The new digital invoice format standards require businesses to adopt XML-based structured data formats that include mandatory fields, standardized coding systems, and digital signature requirements. These standards ensure uniformity across all UAE e-invoicing transactions while maintaining data security and authenticity.

| XML Structure | Standardized XML schema compliance | Mandatory data fields, validation rules | System integration requirements |

| Digital Signatures | Cryptographic signature implementation | Certificate-based authentication | Security enhancement needs |

| Data Fields | Comprehensive transaction information | VAT details, party identification | Enhanced data capture |

| Coding Standards | Unified classification systems | Product codes, tax codes | Standardization requirements |

| Language Support | Arabic and English compatibility | Bilingual data presentation | Multilingual system needs |

These format standards ensure consistency, security, and regulatory compliance while facilitating automated processing and data verification across the UAE’s business ecosystem.

How Do These Standards Differ from Current Invoicing Practices?

Current invoicing practices primarily rely on PDF documents, paper invoices, and unstructured digital formats that lack standardization and real-time reporting capabilities. The new standards require structured data, mandatory field completion, and direct integration with FTA systems that fundamentally change invoice processing workflows.

The transition involves moving from flexible format options to rigid compliance structures, from manual processes to automated systems, and from periodic reporting to real-time data transmission that requires significant system upgrades and process modifications.

What Integration Requirements Must Businesses Meet with FTA Portal?

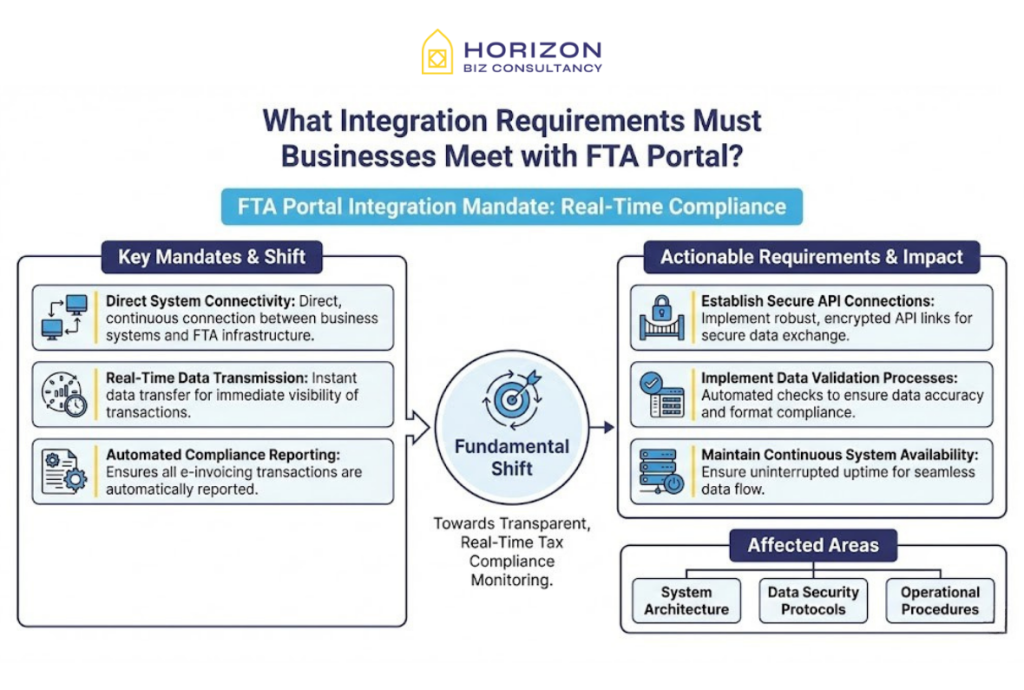

Integration requirements with the FTA portal mandate direct system connectivity, real-time data transmission, and automated compliance reporting that ensures all e-invoicing transactions are immediately visible to tax authorities. This integration represents a fundamental shift toward transparent, real-time tax compliance monitoring.

Businesses must establish secure API connections, implement data validation processes, and maintain continuous system availability that supports seamless data flow between internal systems and FTA infrastructure. These requirements affect system architecture, data security protocols, and operational procedures.

What Technical Integration Components Are Required?

| API Connectivity | Secure REST/SOAP API implementation | System development, testing | FTA-approved protocols |

| Data Validation | Real-time validation against FTA rules | Error handling, correction processes | Compliance verification |

| Security Protocols | Encryption, authentication standards | Certificate management, security layers | Data protection requirements |

| System Availability | 24/7 operational capability | Redundancy, backup systems | Service level agreements |

| Error Management | Exception handling, retry mechanisms | Automated resolution, manual intervention | Recovery procedures |

These technical components ensure reliable, secure, and compliant data exchange between business systems and FTA infrastructure while maintaining operational efficiency and regulatory adherence.

How Will Real-Time Data Transmission Work?

Real-time data transmission requires immediate invoice data submission to FTA systems upon transaction completion, enabling instant compliance verification and automated tax monitoring. This process involves automatic data capture, validation, transmission, and confirmation that ensures complete transaction visibility.

The system processes invoice data instantly, validates compliance requirements, updates tax records, and provides immediate feedback to businesses regarding transaction status and any compliance issues requiring attention.

What System Capabilities Must Businesses Develop?

Businesses must develop automated data extraction capabilities, real-time processing systems, error handling mechanisms, and compliance monitoring tools that support seamless e-invoicing operations. These capabilities require significant technology investments and operational process redesign.

How Will the Transition from Paper to Digital Invoicing Impact Businesses?

The transition from paper to digital invoicing will fundamentally transform business operations, requiring comprehensive system upgrades, staff training, and process redesign that affects every aspect of transaction processing and record keeping.

This transformation impacts accounting workflows, customer interactions, supplier relationships, and internal controls while creating opportunities for improved efficiency, reduced costs, and enhanced compliance monitoring capabilities.

What Operational Changes Will Businesses Experience?

| Invoice Creation | Manual document preparation | Automated system generation | Software upgrade requirements |

| Data Entry | Manual input, paper handling | Automated data capture | Process redesign needs |

| Storage Systems | Physical filing, PDF storage | Structured digital repositories | Infrastructure changes |

| Approval Workflows | Paper-based authorization | Digital approval systems | Workflow automation |

| Record Keeping | Manual filing systems | Automated compliance tracking | System integration requirements |

These operational changes require comprehensive change management, staff training, and system implementation that transforms traditional business processes into digital-first operations.

What Timeline Should Businesses Follow for Implementation?

Businesses should begin preparation immediately with system assessment, vendor selection, and pilot testing phases leading up to the July 2026 mandatory implementation date. The timeline includes planning phases, development periods, testing cycles, and full deployment stages.

Early preparation ensures adequate time for system development, staff training, process optimization, and compliance verification while avoiding last-minute implementation challenges that could disrupt business operations.

How Will Customer and Supplier Relationships Change?

Customer and supplier relationships will require coordinated digital adoption, shared system compatibility, and collaborative compliance management that ensures seamless transaction processing across business partnerships. This coordination involves mutual system upgrades, data sharing agreements, and compliance alignment.

What Are the Key Benefits of UAE’s New E-Invoicing System?

UAE’s new e-invoicing system provides enhanced compliance monitoring, reduced processing costs, improved data accuracy, and streamlined business operations that create significant value for both businesses and tax authorities.

The system eliminates manual errors, reduces processing time, enhances audit trails, and provides real-time compliance visibility that improves business efficiency while strengthening tax compliance infrastructure.

How Will E-Invoicing Improve Business Efficiency?

| Processing Speed | Manual handling, delays | Instant automated processing | Faster transaction cycles |

| Error Reduction | Manual entry mistakes | Automated validation | Improved accuracy |

| Cost Savings | Paper, printing, storage costs | Digital processing economies | Reduced operational expenses |

| Compliance Monitoring | Periodic manual reviews | Real-time automated tracking | Enhanced compliance assurance |

| Data Analytics | Limited reporting capabilities | Comprehensive digital insights | Better business intelligence |

These efficiency improvements create competitive advantages while ensuring regulatory compliance through automated, accurate, and cost-effective transaction processing systems.

What Long-Term Advantages Will Businesses Gain?

Long-term advantages include improved cash flow management through faster processing, enhanced business intelligence through detailed transaction data, and stronger compliance foundations that support business growth and expansion opportunities.

What Preparation Steps Should Businesses Take Now?

Businesses should immediately begin comprehensive preparation including system assessment, vendor evaluation, staff training planning, and implementation roadmap development that ensures successful e-invoicing adoption by the July 2026 deadline.

Preparation involves understanding current system capabilities, identifying upgrade requirements, selecting appropriate technology solutions, and developing change management strategies that minimize business disruption during the transition period.

What System Assessment Should Businesses Conduct?

| Current Technology | System compatibility, upgrade needs | Can existing systems support e-invoicing? | Infrastructure assessment |

| Data Management | Data quality, structure requirements | Is current data suitable for structured formats? | Data cleanup, standardization |

| Process Workflows | Current procedures, automation opportunities | Which processes need redesign? | Workflow optimization |

| Staff Capabilities | Training needs, skill gaps | What training is required? | Training program development |

| Vendor Selection | Solution providers, implementation support | Which vendors offer suitable solutions? | Vendor evaluation, selection |

Comprehensive assessment ensures informed decision-making and effective implementation planning that addresses all critical success factors for e-invoicing adoption.

How Should Businesses Choose Technology Solutions?

Businesses should evaluate technology solutions based on FTA compliance capabilities, integration flexibility, scalability options, and vendor support quality that ensures long-term success and regulatory adherence.

Selection criteria should emphasize proven compliance track records, comprehensive integration capabilities, robust security features, and ongoing support services that provide confidence in successful e-invoicing implementation.

Conclusion

UAE’s e-invoicing requirements represent a transformative shift toward digital compliance that will fundamentally change how businesses process transactions and maintain tax compliance. The July 2026 implementation deadline requires immediate preparation to ensure successful adoption of new digital invoice formats, FTA portal integration, and comprehensive transition from traditional paper-based systems.

Businesses that begin preparation now will gain competitive advantages through improved efficiency, enhanced compliance capabilities, and stronger operational foundations while avoiding the challenges of last-minute implementation. The transition to e-invoicing offers significant long-term benefits including cost savings, improved accuracy, and better business intelligence that support sustainable growth and regulatory excellence.

Understanding and preparing for these changes ensures businesses can leverage the full benefits of digital transformation while meeting all compliance requirements effectively and efficiently.

FAQ’s

E-invoicing becomes mandatory starting July 2026 for all B2B and B2G transactions in the UAE, requiring businesses to complete system implementation and compliance preparation before this deadline.

All businesses conducting B2B (business-to-business) and B2G (business-to-government) transactions in the UAE must comply with e-invoicing requirements, regardless of size or industry.

No, businesses must transition to structured XML-based digital formats that comply with FTA specifications. Traditional PDF invoices will not meet the new e-invoicing requirements.

Non-compliance with e-invoicing requirements may result in penalties, compliance issues, and operational difficulties. Businesses should begin preparation immediately to avoid last-minute implementation challenges.

Implementation costs vary based on current system capabilities, chosen solutions, and business complexity. Early planning helps optimize costs and identify the most cost-effective implementation approach.