UAE Permits 100% Foreign Ownership of Businesses

The UAE has changed its rules to let people from other countries fully own companies here. The government made this big change to get more foreign investors and businesses. Let’s understand what it means and how you can now start your own company in the UAE more easily.

What are the new ownership rules?

Before, foreigners could only own 49% of their business in the UAE. The rest 51% had to be owned by a UAE national. Now that limit is gone. With the new reforms, you can have 100% ownership and control of your company on the UAE mainland and free zones.

Some key things about the new rules:

- Applies to most sectors like trade, industry, services, etc. But some sensitive areas still have limits.

- Mainland and free zone companies both allow full ownership now

- Existing part-ownerships also allowed to switch to 100% foreign control

Why this change to attract investors?

The UAE is a leading global business hub. But some foreign companies still felt unsure to set up here before. Why? Because they worried about having less control in a shared company. Also, taking back all your profits was complex in partnerships.

Now the government has removed these barriers. They want to pull in investors, especially in futuristic sectors like technology, artificial intelligence, computer electronics, etc. The full ownership will give confidence to them to pick the UAE and drive innovation.

Supporting Innovative Sectors

The UAE realizes that new age sectors like computer electronics, artificial intelligence, robotics, genetics engineering, and more will define the future. They want to actively support and promote these industries. Allowing 100% foreign ownership makes it attractive for foreign tech firms, startups, and entrepreneurs to choose the UAE to set up and grow these sectors.

Boosting Foreign Investment

By allowing full ownership, the UAE also aims to bring in more foreign capital and investment into it’s economy. Investors earlier were hesitant to commit large sums when their control and profits were limited. The reforms give them confidence that their investments, assets, and commercial interests will remain fully theirs as they build business here. This will lead to billions flowing into the UAE economy.

How is owning mainland firm different from free zone?

Foreign investors have two options now to set up in the UAE:

Mainland LLC:

- Can work across UAE plus export abroad

- Get visas easier for staff

- Office set up costs lower

- More access to local markets

- Needs local registered agent

Free Zone Company:

- Zero tax rates

- Less paperwork

- Flexible visa rules

- Own office spaces

- Only work inside specific zone area

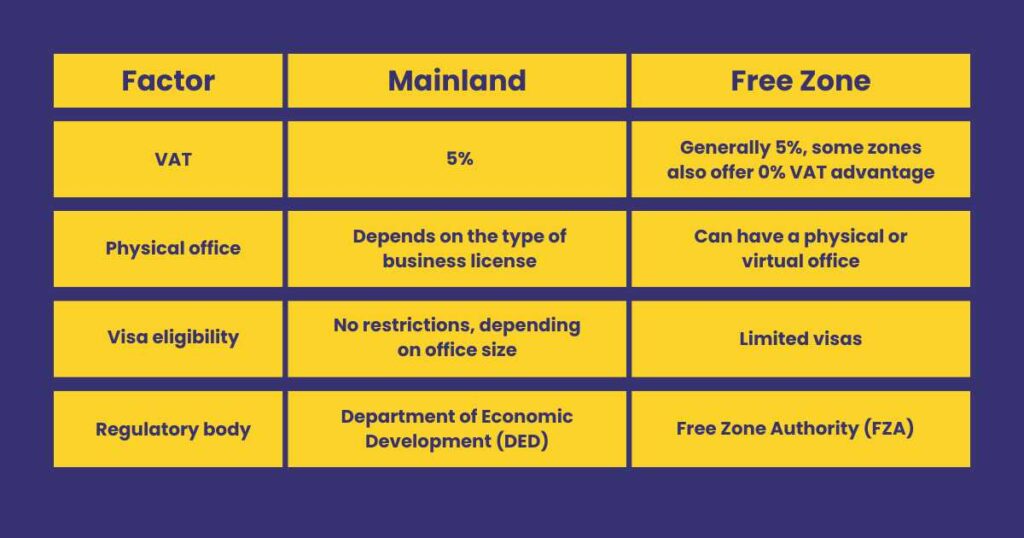

Key Differences Between Mainland and Free Zone Companies in Dubai

Choosing between a mainland and a free zone company setup in Dubai depends on your specific business goals and needs. Here’s a breakdown of the key differences to help you decide:

Market Access:

- Mainland: Companies have full access to the entire UAE market, allowing them to trade freely within the country.

- Free Zone: Companies can primarily trade with other companies within the free zone and internationally. They typically require a local distributor or agent to sell goods in the mainland market.

Ownership:

- Mainland: Non-UAE nationals can own a maximum of 49% of a mainland company, with a local Emirati partner holding the remaining 51%.

- Free Zone: Companies can enjoy 100% foreign ownership, offering greater control and flexibility.

Taxes:

- Mainland: Mainland companies are subject to corporate and personal income taxes, although rates can be lower compared to other countries.

- Free Zone: Free zone companies are generally exempt from corporate and personal income taxes, offering significant cost savings.

Fees and Regulations:

- Mainland: Setting up a mainland company typically involves more complex procedures and higher initial costs compared to free zones.

- Free Zone: Free zones have simpler setup processes and offer competitive fees, but may have specific regulations depending on the zone’s focus.

Import and Export Duties:

- Mainland: Mainland companies may be subject to import and export duties depending on the products they trade.

- Free Zone: Free zone companies typically benefit from exemptions on import and export duties, facilitating international trade.

Office Space:

- Mainland: Mainland companies require a physical office space within the UAE.

- Free Zone: Some free zones offer the option of virtual offices, reducing setup costs.

Step-by-Step Process to Register Your New Company

With the ownership reforms in place, below are the usual steps to set up your dream business in the UAE:

Choose the Right Location : Look if mainland or free zone fits your work better. Some zones like Dubai Silicon Oasis are best for tech startups. While mainland has wider local access.

Get Approvals for Your Line of Business : Some activities need extra permits. The authority will guide your application and requirements for approval. Be clear on your activity area from start.

Finalize Office Address: Rent space in a shared building or commercial zone based on your activities. Your license will include this address. Make sure it meets set up needs.

Complete Documentation: Prepare all paperwork like owner IDs, lease deeds, and detailed business plan. Banks need these to open your company account. Keep multiple copies ready.

Register with Department of Economic Development : File all documents and pay fees to legally create your business entity. This may take 2-10 days. Have all forms pre-verified to avoid delays.

Apply for Visas and Permits : To hire staff, start visa procedures and get signboards/equipment permits if needed. Staff visas can take weeks to process.

Follow these key steps, and you can have your company up and running smoothly in 30-60 days!

Benefits of 100% Business Ownership in the UAE

The 2021 amendment to the CCL has further revolutionised the UAE’s business potential, facilitating incorporations and enhancing the country’s reputation as an investment-friendly jurisdiction. Among the many benefits are:

- New foreign investors from around the globe will be attracted to the UAE and are increasingly likely to set up their businesses in the jurisdiction.

- The Emirates economic sectors will develop. To take just one example, environmentally-friendly activities like hybrid power plants, solar panels and other eco technologies will grow with the aid of overseas investment and talent.

- As a result of the new business incorporations and a rise in investment and talent, the UAE will see its global competitiveness skyrocket.

Conclusion

The UAE opening doors for 100% foreign ownership is a game changer. It brings amazing opportunities for global businesses, especially in future-focused sectors. With world-class infrastructure and easy access to markets, the UAE provides the perfect launchpad now for foreign investors and entrepreneurs to grow. Contact investment advisors and kickstart your company registration today!

FAQs

All non-sensitive sectors like IT, consultancy, education, healthcare, tourism, etc. can have full foreign control now.

Earlier a UAE national agent was compulsory. This rule has now been scrapped in the new policy.

Registration fees start from AED 15,000-20,000 plus costs for office lease and visas. Free zones may be pricier.

You need to pay license renewal fees, office rent, staff costs and fees for residency visas every year. Keep buffer funds.