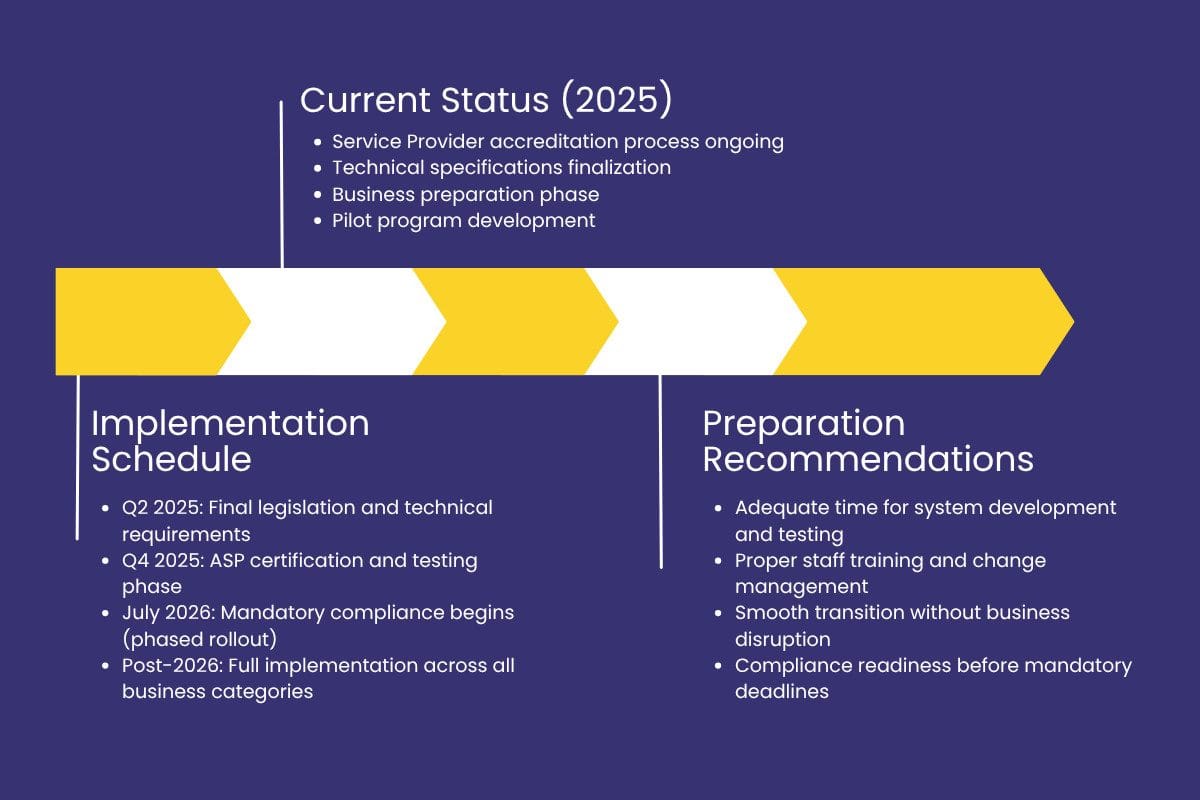

Expert guidance for mandatory e-invoicing implementation from July 2026

E-invoicing refers to the electronic generation, submission, and storage of invoices using standardized digital formats as mandated by the UAE Federal Tax Authority. Starting July 2026, all B2B and B2G transactions must comply with the new Peppol-based electronic invoicing framework.

Regulatory Framework:

The UAE’s e-invoicing system operates on the Peppol 5-corner decentralized model, requiring businesses to:

Our team has successfully guided numerous UAE businesses through major regulatory implementations including VAT introduction in 2018 and Corporate Tax implementation in 2023. We understand the complexities of regulatory compliance and the importance of seamless business continuity.

With deep knowledge of both accounting systems and UAE regulatory requirements, we provide practical solutions that work in real business environments. Our approach balances technical compliance with operational efficiency.

Based in Dubai with established relationships with FTA officials and regulatory bodies, we stay current with regulatory developments and can provide timely guidance on compliance requirements.

We understand that every business is unique. Our services are customized to your specific industry, business model, and operational requirements, whether you operate in Free Zones, Mainland, or across multiple entities.

All UAE Businesses Issuing Invoices:

Business Structure Considerations:

Generate invoices in standardized structured digital formats

• Establish connectivity through an Accredited Service Provider (ASP)

• Real-time integration with the FTA systems (using Peppol model)

• Maintain secure digital storage (audit-trail) for at least five years

Yes. Whether your company is in a Free Zone (e.g. DMCC, Dubai Silicon Oasis), Mainland UAE, or has an offshore entity with UAE operations, compliance is required if you issue invoices falling under the FTA’s mandates.

Yes. Horizon Biz offers ASP selection and management support, including vendor evaluation, contract negotiation, integration coordination, and ongoing relationship oversight.