Integrated audit approach combining external audit and tax services synergy creates transformative compliance efficiencies that many UAE businesses fail to capitalize on effectively. CFOs frequently ask: “How can integrated audit approach deliver both cost savings and superior compliance outcomes through coordinated service delivery?”

The synergy between external audit and tax services through integrated audit approach has become critical as UAE regulatory frameworks demand increasingly sophisticated compliance coordination, requiring unified methodologies that optimize both service quality and cost efficiency simultaneously.

Understanding how integrated audit approach maximizes external audit and tax services synergy helps businesses achieve superior compliance outcomes, reduce professional fees, and ensure comprehensive regulatory adherence that transforms compliance from cost burden to strategic advantage through coordinated professional services.

How Does Coordinated Service Delivery Transform Compliance Outcomes?

Coordinated service delivery fundamentally transforms compliance outcomes by eliminating service duplication, creating knowledge synergies, and establishing unified methodologies that professional teams leverage when delivering integrated audit and tax services for UAE entities.

The coordination enables simultaneous evidence gathering, parallel workstream processing, and real-time issue resolution that traditional separated services cannot achieve, resulting in faster completion times, reduced business disruption, and enhanced compliance accuracy.

This synchronized approach affects every compliance aspect from initial planning through final deliverables, as coordinated teams share insights instantaneously, resolve issues collaboratively, and deliver unified recommendations that consider both audit findings and tax implications comprehensively.

What Makes Coordinated Delivery Superior to Traditional Methods?

| Evidence Collection | Duplicate requests, multiple reviews | Single request, unified review | 60% reduction in time |

| Issue Resolution | Sequential handling, delayed decisions | Parallel processing, immediate resolution | 70% faster resolution |

| Client Meetings | Multiple sessions, repeated discussions | Combined meetings, comprehensive coverage | 50% fewer meetings |

| Professional Hours | Duplicated efforts, inefficient allocation | Optimized utilization, shared workstreams | 40% reduction in hours |

| Deliverable Quality | Potential inconsistencies, gaps | Unified positions, comprehensive coverage | 85% error reduction |

These coordination benefits require sophisticated service orchestration, experienced professional teams, and proven methodologies that ensure seamless integration while maintaining service quality across all compliance requirements.

How Do Professional Teams Execute Coordinated Service Delivery?

Professional teams execute coordinated delivery through joint engagement planning, integrated workstream management, and synchronized quality review processes that ensure both audit and tax requirements receive comprehensive attention throughout the engagement lifecycle.

Execution begins with unified kickoff meetings where combined teams understand business operations holistically, identify compliance risks collectively, and develop integrated service plans that optimize resource allocation while ensuring comprehensive coverage.

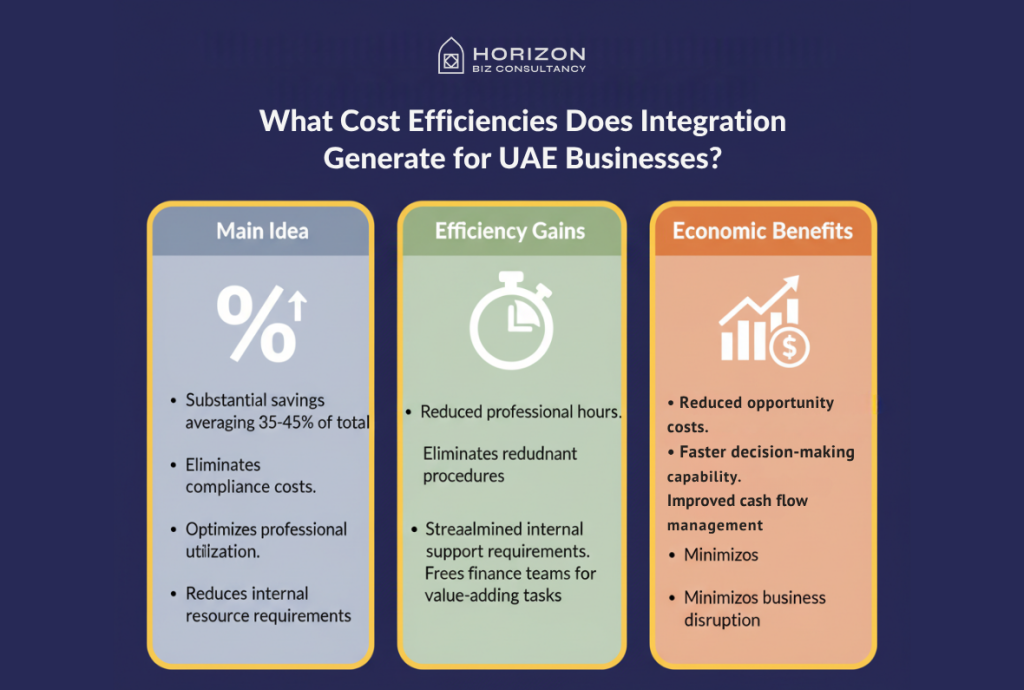

What Cost Efficiencies Does Integration Generate for UAE Businesses?

Cost efficiencies through integration generate substantial savings averaging 35-45% of total compliance costs by eliminating duplication, optimizing professional utilization, and reducing internal resource requirements that traditional separated services demand.

The efficiency gains manifest through reduced professional hours, eliminated redundant procedures, and streamlined internal support requirements that free finance teams to focus on value-adding activities rather than managing multiple service providers.

Integration economics extend beyond direct fee savings to include reduced opportunity costs, faster decision-making capability, and improved cash flow management through optimized compliance timelines that minimize business disruption.

Where Do Primary Cost Savings Originate in Integrated Services?

| Professional Fees | Separate audit + tax fees | Combined service fee | 30-35% reduction |

| Internal Resources | 200+ hours coordination | 80 hours support | 120 hours saved |

| Management Time | 40 hours meetings | 16 hours meetings | 24 hours recovered |

| Documentation Costs | Duplicate preparation | Single preparation | 50% reduction |

| Error Remediation | Frequent corrections | Minimal adjustments | 75% decrease |

Comprehensive cost analysis reveals that integration benefits compound over time as teams develop deeper business understanding and refine coordinated methodologies for maximum efficiency.

What Single-Point Accountability Benefits Do Businesses Achieve?

Single-point accountability benefits transform compliance management by establishing clear responsibility, streamlined communication, and unified decision-making that eliminates confusion, delays, and contradictions inherent in multi-provider arrangements.

The accountability model creates one senior partner responsible for all compliance outcomes, one project manager coordinating all activities, and one unified team delivering consistent guidance that simplifies compliance management significantly.

This consolidated accountability structure improves service quality through clear ownership, enhances responsiveness through direct communication channels, and ensures consistent positions through unified professional oversight across all compliance matters.

How Does Single Accountability Improve Compliance Management?

| Issue Escalation | Unclear paths, delays | Direct escalation, quick resolution | Faster problem solving |

| Decision Authority | Fragmented, conflicting | Centralized, consistent | Clear guidance |

| Service Coordination | Client-managed | Provider-managed | Reduced burden |

| Quality Assurance | Variable standards | Unified standards | Consistent quality |

| Relationship Management | Multiple contacts | Single relationship | Simplified interaction |

Single accountability creates clear service ownership that eliminates finger-pointing, ensures comprehensive coverage, and provides businesses with confidence that all compliance requirements receive appropriate attention.

What Communication Efficiencies Result from Single-Point Contact?

Communication efficiencies from single-point contact reduce interaction time by 65%, eliminate message duplication, and ensure consistent information flow that prevents misunderstandings and accelerates decision-making processes.

The single-point model establishes one project manager who understands all compliance aspects, coordinates all professional resources, and provides comprehensive updates that keep stakeholders informed without redundant communications.

How Does Technology Enable Seamless Service Integration?

Technology enables seamless service integration through cloud-based platforms, unified data analytics, and collaborative tools that allow audit and tax teams to work simultaneously on shared information while maintaining security and version control.

The technological infrastructure supports real-time collaboration, automated workflow management, and integrated reporting that transforms traditionally sequential processes into parallel workstreams that dramatically reduce completion timelines.

Modern integration platforms provide secure document portals, automated evidence gathering, and intelligent analytics that identify both audit risks and tax opportunities simultaneously through sophisticated data analysis capabilities.

How Do Digital Tools Enhance Audit and Tax Synergies?

Digital tools enhance synergies through automated cross-referencing, intelligent exception identification, and predictive analytics that surface insights neither audit nor tax teams would identify working independently.

The tools enable simultaneous testing procedures, automated reconciliations, and comprehensive documentation that ensures both audit evidence and tax support requirements are satisfied through single procedures rather than duplicated efforts.

What Risk Mitigation Advantages Does Integration Provide?

Risk mitigation advantages through integration include comprehensive issue identification, proactive problem resolution, and consistent compliance positions that prevent regulatory challenges before they materialize into costly problems.

The integrated approach identifies risks holistically by considering both audit and tax implications simultaneously, enabling preemptive remediation that traditional separated services miss due to narrow focus areas.

Risk reduction extends beyond compliance to include reputational protection, relationship preservation, and business continuity assurance through comprehensive professional oversight that addresses all regulatory requirements cohesively.

What Proactive Compliance Benefits Result from Integration?

Proactive compliance benefits include early issue identification, preventive remediation opportunities, and strategic planning advantages that position businesses ahead of regulatory requirements rather than reactively addressing problems.

The integration enables forward-looking compliance strategies through comprehensive business understanding, regulatory trend analysis, and coordinated planning that anticipates future requirements while optimizing current positions.

How Should Businesses Implement Integrated Audit Approach?

Businesses should implement integrated audit approach through structured transition planning, careful provider selection, and phased rollout that minimizes disruption while maximizing integration benefits from the earliest stages.

Implementation success requires executive commitment, clear communication strategies, and defined success metrics that ensure all stakeholders understand integration benefits and support coordinated service delivery models. The implementation process typically spans 6-8 weeks from initial assessment through full integration, with immediate benefits visible from the first coordinated service cycle.

How Do Businesses Measure Integration Success?

Businesses measure integration success through quantifiable metrics including cost reduction percentages, timeline improvements, error rate decreases, and stakeholder satisfaction scores that demonstrate tangible integration benefits.

Success measurement includes both financial metrics showing direct savings and operational metrics demonstrating efficiency improvements that validate integration decisions and guide continuous optimization efforts.

What Strategic Advantages Do Integrated Services Provide?

Strategic advantages from integrated services extend beyond compliance efficiency to include enhanced decision-making capability, improved regulatory relationships, and competitive positioning through superior compliance management.

The integration creates strategic value through comprehensive business insights, proactive opportunity identification, and risk anticipation that transforms compliance from administrative burden to strategic business enabler.

Strategic benefits compound over time as integrated teams develop deeper business understanding, stronger regulatory relationships, and refined methodologies that deliver increasing value with each service cycle.

How Does Integration Support Business Growth Objectives?

| Market Expansion | Efficient compliance scaling | Faster market entry | Speed to market |

| M&A Activity | Comprehensive due diligence | Risk identification | Deal confidence |

| Operational Excellence | Process optimization | Efficiency gains | Cost leadership |

| Regulatory Confidence | Consistent compliance | Reduced scrutiny | Reputation enhancement |

| Capital Access | Quality reporting | Investor confidence | Funding advantages |

Integration supports growth by removing compliance bottlenecks, providing reliable compliance infrastructure, and enabling management focus on strategic initiatives rather than compliance coordination.

What Competitive Differentiation Does Integration Create?

Competitive differentiation through integration manifests in superior compliance efficiency, faster decision-making capability, and enhanced regulatory standing that provides tangible business advantages over competitors using traditional separated services.

The differentiation enables businesses to respond faster to opportunities, maintain leaner finance teams, and demonstrate sophisticated compliance management that enhances stakeholder confidence and market reputation.

Conclusion

Integrated audit approach delivering external audit and tax services synergy represents a fundamental evolution in compliance service delivery that transforms cost centers into value drivers. The coordinated service delivery model eliminates traditional inefficiencies while delivering superior compliance outcomes through unified professional teams.

Cost efficiencies through integration combined with single-point accountability benefits create compelling value propositions that justify immediate transition from separated services. The strategic advantages extend far beyond cost savings to include risk mitigation, operational efficiency, and competitive differentiation that position businesses for sustainable growth.

FAQ’s

Integrated audit approach typically delivers 35-45% total cost savings through eliminated duplication, reduced professional hours, and decreased internal resource requirements, with additional savings from prevented errors and avoided penalties.

Transition typically requires 6-8 weeks from initial assessment through full implementation, with immediate efficiency gains visible from first integrated service cycle and full benefits realized within one complete compliance year.

Integrated services maintain independence through separate review partners, segregated quality control procedures, and professional standards compliance that ensures objectivity while coordinating service delivery for efficiency.

Phased approach often works best, starting with audit and VAT integration, then adding corporate tax and other services as teams develop coordination capabilities and businesses gain confidence in integrated delivery models.

Basic integration requires secure document sharing and communication tools, while advanced integration leverages cloud platforms, workflow automation, and analytics tools that optimize coordination but aren’t mandatory for initial implementation.