Economic Substance Regulations (ESR) and external audit integration creates complex compliance requirements that many UAE businesses struggle to coordinate effectively. Business owners frequently ask: “How do I ensure my external audit properly addresses Economic Substance requirements without creating additional compliance burdens?”

The integration of ESR compliance with external audit processes has become essential as UAE authorities increasingly scrutinize the alignment between audit findings and Economic Substance reporting, requiring coordinated approaches that satisfy both regulatory frameworks simultaneously.

Understanding how ESR requirements integrate with external audit obligations helps businesses streamline compliance, reduce costs, and ensure comprehensive regulatory adherence that protects business operations while meeting evolving UAE regulatory expectations across multiple compliance frameworks.

How Do Economic Substance Regulations Impact External Audit Requirements?

Economic Substance Regulations significantly impact external audit requirements by creating additional verification obligations, expanded audit scope, and enhanced documentation requirements that auditors must address when conducting external audits for UAE entities engaged in relevant activities.

The integration requires auditors to verify Economic Substance compliance evidence, assess the adequacy of substance arrangements, and provide audit opinions that consider both traditional financial statement accuracy and Economic Substance regulatory compliance requirements.

This expanded scope affects audit planning, evidence gathering, reporting requirements, and auditor qualifications, as external audits must now address substance arrangements, core income-generating activities, and regulatory compliance beyond traditional financial statement auditing.

What Additional Audit Procedures Does ESR Compliance Require?

| Adequate Employees | Headcount verification | Employment records, qualifications | Staff validation procedures |

| Adequate Expenditure | Cost verification | Expense documentation, allocation | Enhanced cost analysis |

| Core Activities | Activity assessment | Operational evidence, decision records | Expanded scope review |

| UAE Decision-Making | Authority verification | Board minutes, management evidence | Governance assessment |

| Economic Presence | Physical verification | Office leases, facility documentation | Location validation |

These additional procedures require enhanced audit planning, specialized expertise, and comprehensive evidence gathering that extends traditional audit scope to address regulatory compliance requirements.

How Do Auditors Verify Economic Substance Compliance During External Audits?

Auditors verify Economic Substance compliance through detailed testing of substance arrangements, review of supporting documentation, assessment of business operations, and evaluation of regulatory filing accuracy that demonstrates compliance with ESR requirements.

Verification procedures include examining employment records, testing expenditure allocations, reviewing decision-making processes, and assessing core income-generating activities that support Economic Substance positions reported to regulatory authorities.

What ESR Reporting Must Be Integrated Within the Audit Framework?

ESR reporting integration within audit frameworks requires coordinated compliance approaches that ensure external audit findings support Economic Substance filing positions while maintaining audit independence and professional standards.

The integration involves aligning audit procedures with ESR reporting requirements, ensuring audit evidence supports substance positions, and coordinating audit timelines with ESR filing deadlines to create efficient compliance processes.

Successful integration requires understanding both audit standards and ESR requirements, implementing coordinated procedures, and ensuring audit findings provide adequate support for regulatory compliance without compromising audit quality or independence.

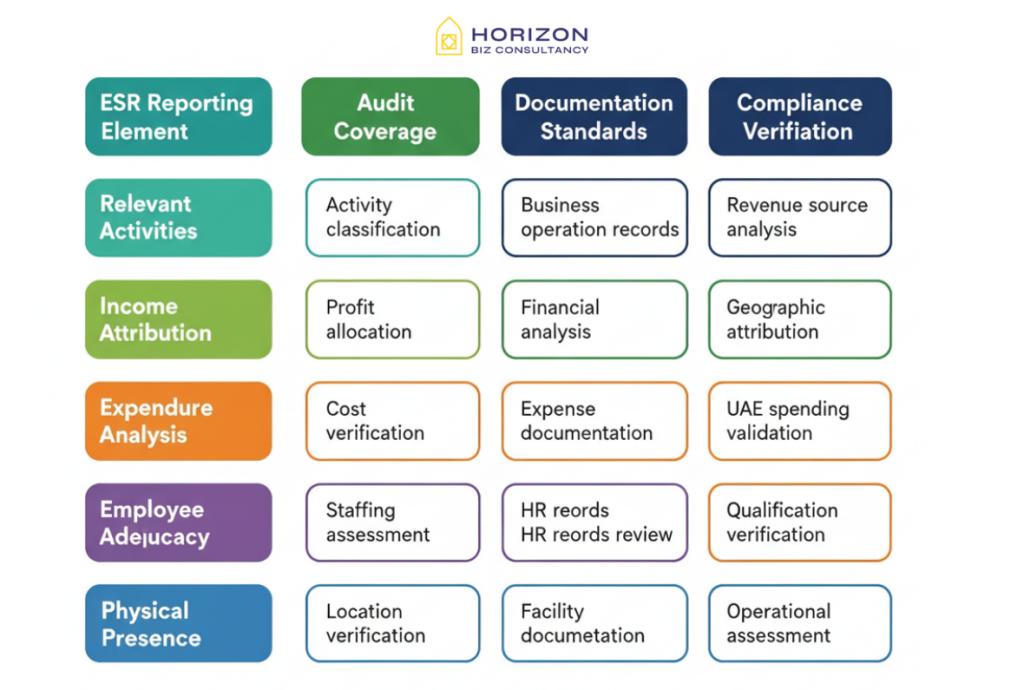

What ESR Information Must External Audits Address?

| Relevant Activities | Activity classification | Business operation records | Revenue source analysis |

| Income Attribution | Profit allocation | Financial analysis | Geographic attribution |

| Expenditure Analysis | Cost verification | Expense documentation | UAE spending validation |

| Employee Adequacy | Staffing assessment | HR records review | Qualification verification |

| Physical Presence | Location verification | Facility documentation | Operational assessment |

Comprehensive audit coverage ensures that ESR reporting positions are supported by verified evidence and consistent with audit findings across all material aspects of Economic Substance compliance.

How Do Audit Timelines Align with ESR Filing Requirements?

Audit timelines must align with ESR filing requirements through coordinated planning that ensures audit completion provides adequate time for ESR preparation while meeting both audit deadlines and regulatory filing requirements.

This coordination requires early planning, integrated service delivery, and timeline management that optimizes compliance efficiency while ensuring both audit quality and ESR accuracy through properly sequenced professional services.

What Audit Evidence Specifically Supports Economic Substance Requirements?

Audit evidence supporting Economic Substance requirements includes comprehensive documentation of UAE operations, employee arrangements, expenditure patterns, and decision-making processes that demonstrate genuine business substance beyond traditional financial statement verification.

The evidence must demonstrate adequate UAE presence, meaningful business activities, and genuine operational substance that supports ESR positions while meeting audit standards for reliability, relevance, and sufficiency.

Effective evidence gathering requires understanding ESR compliance requirements, implementing targeted audit procedures, and maintaining comprehensive documentation that supports both audit conclusions and regulatory compliance positions.

What Specific Evidence Do Auditors Gather for ESR Compliance?

| Employment Evidence | Contracts, payroll records | Headcount verification | Adequate employees |

| Expenditure Evidence | Invoices, cost allocations | Spending analysis | UAE expenditure |

| Decision Evidence | Meeting minutes, approvals | Authority assessment | UAE decision-making |

| Activity Evidence | Operational records | Process verification | Core activities |

| Physical Evidence | Lease agreements, utilities | Facility verification | UAE presence |

Comprehensive evidence gathering ensures audit procedures provide adequate support for ESR positions while meeting professional auditing standards for evidence quality and reliability.

How Do Auditors Assess the Adequacy of Economic Substance Arrangements?

Auditors assess Economic Substance adequacy through detailed analysis of business operations, evaluation of substance arrangements against regulatory requirements, and professional judgment regarding compliance sufficiency and regulatory alignment.

Assessment procedures include comparative analysis against regulatory guidelines, evaluation of business substance relative to income levels, and assessment of operational arrangements that demonstrate genuine UAE business activities.

How Should Businesses Implement Coordinated ESR and Audit Compliance?

Coordinated ESR and audit compliance requires integrated planning, unified documentation systems, and coordinated professional services that address both requirements simultaneously while optimizing efficiency and reducing compliance costs.

Implementation involves establishing integrated compliance calendars, coordinating service providers, implementing unified documentation systems, and ensuring consistent positions across both audit and ESR requirements.

Successful coordination reduces duplication, improves compliance quality, and ensures consistent regulatory positions while optimizing professional service costs and internal resource allocation across multiple compliance requirements.

What Integration Strategies Optimize ESR and Audit Compliance?

| Unified Service Provider | Single professional firm | Cost efficiency, consistency | Service capability assessment |

| Coordinated Timeline | Aligned compliance calendar | Reduced pressure, efficiency | Resource planning |

| Integrated Documentation | Shared evidence systems | Reduced duplication | System coordination |

| Consistent Positions | Aligned compliance approach | Regulatory consistency | Professional coordination |

Effective integration strategies balance compliance efficiency with quality considerations while ensuring both audit and ESR requirements are met through coordinated professional approaches.

How Do You Ensure Consistent Positions Across Audit and ESR Compliance?

Ensure consistent positions through unified fact development, coordinated analysis, and integrated professional oversight that maintains alignment between audit findings and ESR reporting positions.

This requires establishing common factual foundations, coordinated professional communication, and regular review processes that identify and resolve potential inconsistencies before they create compliance issues.

What Professional Qualifications Are Required for Integrated ESR-Audit Services?

Integrated ESR-audit services require professionals with combined expertise in UAE auditing standards, Economic Substance Regulations, and regulatory compliance that enables effective service delivery across both requirements.

Professional qualifications include audit licensing, ESR expertise, UAE regulatory knowledge, and experience with integrated compliance approaches that demonstrate competency in both disciplines and their coordination.

The complexity of integrated services requires careful professional selection that considers both technical competency and coordination capability essential for successful compliance across multiple regulatory frameworks.

What Expertise Must Professionals Possess for Integrated Services?

| External Audit | UAE audit license | 3+ years UAE audit | Technical competency review |

| ESR Compliance | ESR specialization | ESR filing experience | Regulatory knowledge test |

| UAE Regulations | Local law knowledge | UAE practice experience | Regulatory familiarity |

| Integration Coordination | Multi-service experience | Coordinated delivery | Project management skills |

Comprehensive professional qualifications ensure service quality while providing expertise necessary for effective coordination and compliance across both audit and ESR requirements.

How Do You Select Qualified Professionals for Integrated ESR-Audit Services?

Select qualified professionals through credential verification, experience assessment, reference checking, and capability evaluation that demonstrates competency in both audit and ESR requirements plus coordination ability.

Selection criteria should emphasize integrated service experience, regulatory knowledge, professional qualifications, and demonstrated success with coordinated compliance approaches that optimize outcomes across multiple requirements.

What Documentation Standards Support Both ESR and Audit Requirements?

Documentation standards supporting both ESR and audit requirements include comprehensive record-keeping, systematic organization, and evidence maintenance that satisfies both audit verification needs and ESR compliance documentation.

Effective documentation requires understanding both sets of requirements, implementing systems that support dual purposes, and maintaining records that provide adequate evidence for audit procedures and ESR compliance verification.

Documentation standards must meet audit evidence requirements while supporting ESR reporting positions through comprehensive, organized, and accessible record-keeping that facilitates both compliance processes.

What Documentation Systems Support Dual Compliance Requirements?

| Employee Records | Payroll verification | Headcount evidence | Unified HR documentation |

| Expenditure Tracking | Cost analysis | UAE spending proof | Integrated financial records |

| Decision Documentation | Governance assessment | Authority evidence | Comprehensive management records |

| Activity Records | Operational verification | Core activity proof | Business operation documentation |

Integrated documentation systems reduce duplication while ensuring comprehensive coverage that supports both audit verification and ESR compliance through coordinated record-keeping approaches.

How Do You Maintain Audit-Quality Documentation for ESR Compliance?

Maintain audit-quality documentation through systematic organization, regular updates, comprehensive coverage, and evidence standards that meet both audit reliability requirements and ESR compliance verification needs.

This includes implementing documentation controls, maintaining evidence trails, ensuring record accessibility, and regular review processes that verify documentation adequacy for both compliance purposes.

Conclusion

Economic Substance Regulations and external audit integration creates comprehensive compliance requirements that demand coordinated approaches for optimal efficiency and regulatory adherence. Understanding the intersection between ESR requirements and audit obligations enables businesses to implement integrated compliance strategies that satisfy both frameworks while optimizing costs and reducing regulatory risks.

Successful integration requires professional expertise in both areas, coordinated documentation systems, and unified compliance approaches that ensure consistency across audit findings and ESR reporting. Businesses that effectively coordinate these requirements position themselves for sustainable compliance while minimizing costs and regulatory exposure through comprehensive professional service integration.

FAQ’s

ESR requirements expand external audit scope to include verification of substance arrangements, employee adequacy, UAE expenditure, and core activities, typically increasing audit costs by 15-25% while requiring additional evidence gathering and specialized ESR expertise from audit professionals.

External auditors must consider ESR compliance when it affects financial statement accuracy and business operations, but they don’t provide ESR compliance opinions. However, audit procedures should gather evidence that supports ESR positions and identifies potential compliance issues.

Yes, many professional firms offer integrated services that coordinate external audit and ESR compliance, providing cost efficiencies, consistent positions, and streamlined compliance through unified service delivery and coordinated professional expertise.

Audit completion should precede ESR filing preparation, typically requiring audit finalization by March-April to support June ESR filing deadlines. Coordinated planning ensures audit evidence supports ESR positions while meeting both compliance calendars efficiently.

Conflicting positions create compliance risks requiring immediate resolution through additional analysis, documentation review, or position adjustments that ensure consistency between audit conclusions and ESR reporting while maintaining accuracy in both frameworks.