The UAE’s introduction of corporate tax has fundamentally changed the business landscape for companies operating in the Emirates. As we navigate through 2025, understanding the complete corporate tax filing process has become crucial for business owners, financial managers, and entrepreneurs. This comprehensive guide will walk you through every aspect of UAE corporate tax filing, ensuring you remain compliant while optimizing your tax obligations.

What is UAE Corporate Tax and Why Does It Matter in 2025?

The UAE Federal Corporate Tax came into effect on June 1, 2023, marking a historic shift in the country’s tax framework. This tax applies to businesses and other juridical persons on their profits, with rates varying based on the level of taxable income. For business owners in 2025, understanding this system isn’t just about compliance it’s about strategic financial planning and maintaining your competitive edge in the UAE market.

Key Changes and Updates for 2025

As we progress through 2025, several refinements and clarifications have been made to the corporate tax framework:

- Enhanced digital filing procedures through the EmaraTax portal

- Clearer guidelines for free zone entities

- Updated compliance requirements for small and medium enterprises

- Streamlined processes for tax group formations

Timeline of Corporate Tax Evolution in the UAE

Understanding the evolution of UAE’s corporate tax system helps contextualize current requirements:

June 1, 2023: Corporate tax law officially came into effect

January 2024: First tax period began for calendar year entities

April 2024: Initial tax return filings commenced

Throughout 2024: Ongoing refinements and guidance issued by the Federal Tax Authority (FTA)

2025: Matured system with established procedures and enhanced digital infrastructure

This timeline demonstrates the UAE’s commitment to implementing a robust yet business-friendly tax system that supports economic growth while ensuring fair contribution to national development.

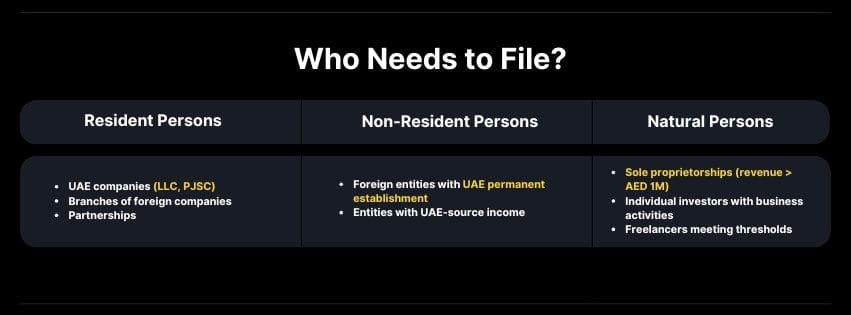

Understanding Taxable Persons: Who Needs to File?

Resident Persons

A juridical person is considered a UAE resident for corporate tax purposes if it’s incorporated or established under UAE law. This includes:

- UAE companies (LLC, PJSC, private companies)

- Branches of foreign companies registered in the UAE

- Partnerships and other business entities established under UAE law

Non-Resident Persons

Foreign entities may also be subject to UAE corporate tax if they have a permanent establishment in the UAE or derive UAE-source income. This includes:

- Foreign companies with UAE branches or representative offices

- Entities conducting business through fixed places of business in the UAE

- Foreign companies earning rental income from UAE real estate

Natural Persons in Business

While individual employees typically aren’t subject to corporate tax, natural persons conducting business activities may fall under the corporate tax regime. This particularly applies to:

- Sole proprietorships with annual revenue exceeding AED 1 million

- Individual investors with significant business activities

- Freelancers and consultants meeting specific thresholds

Mandatory Corporate Tax Return Deadlines: Critical Dates You Cannot Miss

Primary Filing Deadlines

Standard Deadline: 9 months after the end of the tax period

- For calendar year entities (January-December tax period): September 30

- For entities with different year-ends: 9 months from their specific year-end date

First-Time Filers: 15 months after the end of their first tax period

- This extended deadline applies only to the very first corporate tax return

- Subsequent returns follow the standard 9-month rule

Important Pre-Filing Requirements

Tax Registration: Must be completed within 3 months of meeting the registration threshold

Notification of Tax Period: Required if adopting a non-calendar tax year

Appointment of Tax Agent: If applicable, must be done before filing

Consequences of Missing Deadlines

Late filing penalties can be severe:

- Administrative penalties starting from AED 10,000

- Additional penalties of 5% of tax due for each complete month of delay

- Potential suspension of business licenses in extreme cases

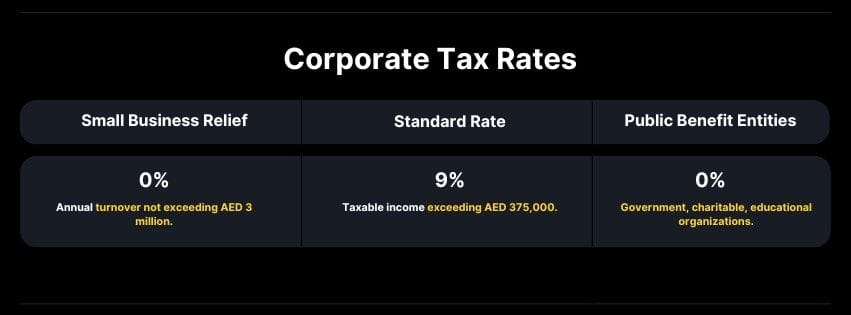

Corporate Tax Rates: Understanding Your Calculation

The UAE employs a tiered corporate tax structure designed to support small businesses while ensuring larger enterprises contribute appropriately:

Tax Rate Structure for 2025

Small Business Relief: 0% tax rate

- Applies to businesses with annual turnover not exceeding AED 3 million

- Must meet specific qualifying conditions

- Includes natural persons conducting business activities

Standard Rate: 9% tax rate

- Applies to taxable income exceeding AED 375,000

- Standard rate for most UAE businesses

- Applicable to both UAE resident and non-resident persons

Qualifying Public Benefit Entities: 0% tax rate

- Government entities

- Government-controlled entities meeting specific criteria

- Certain charitable and educational organizations

Effective Tax Rate Planning

For businesses with taxable income above AED 375,000:

- First AED 375,000: 0% tax rate

- Income exceeding AED 375,000: 9% tax rate

- This creates a progressive tax structure that supports growing businesses

Elections: Making Strategic Tax Decisions

Mandatory Elections

Tax Period Election: Choose between calendar year (January-December) or a different 12-month period

Accounting Method Election: Select cash or accrual accounting method

Functional Currency Election: Determine the currency for tax calculations

Optional Elections

Tax Group Formation: Consolidate multiple entities for tax purposes

Simplified Compliance: Available for qualifying small businesses

Installment Payment Plans: For businesses meeting specific criteria

Strategic Considerations for Elections

When making tax elections, consider:

- Your business’s cash flow patterns

- Seasonal variations in income

- Administrative burden and compliance costs

- Long-term business planning objectives

The timing of these elections is crucial, as most can only be made at specific times and may be difficult to change once implemented.

Free Zone Qualification: Navigating Special Considerations

Free Zone Person Status

Free zone entities may qualify for 0% corporate tax rate if they meet specific conditions:

Qualifying Free Zone Person Requirements:

- Maintains adequate substance in the free zone

- Only earns qualifying income

- Doesn’t elect to be subject to corporate tax

- Properly maintains books and records

Adequate Substance Requirements

To maintain free zone qualification, entities must demonstrate:

- Core income-generating activities conducted in the UAE

- Adequate number of qualified employees

- Adequate amount of expenditure incurred in the UAE

- Physical presence and operations within the free zone

Qualifying Income Definition

Free zone entities can only earn specific types of income to maintain their 0% tax status:

- Income from transactions with persons outside the UAE

- Income from transactions with other qualifying free zone persons

- Certain types of intellectual property income

- Dividends and capital gains from qualifying investments

Common Disqualifying Activities

Activities that may disqualify free zone status include:

- Significant domestic UAE transactions

- Banking, insurance, or financing activities (with exceptions)

- Natural resource extraction

- Real estate transactions within the UAE

Step-by-Step Corporate Tax Filing Process

Step 1: Pre-Filing Preparation

Gather Required Documents:

- Audited financial statements

- General ledger and supporting documentation

- Details of all income sources

- Documentation of allowable expenses

- Transfer pricing documentation (if applicable)

Verify Tax Registration Status:

- Ensure corporate tax registration is current

- Update any changes in business information

- Confirm tax agent appointments if applicable

Step 2: Calculate Taxable Income

Start with Accounting Profit:

- Begin with profit before tax from audited financial statements

- Apply UAE corporate tax adjustments

- Consider timing differences and permanent differences

Apply Specific Adjustments:

- Add back non-deductible expenses

- Subtract exempt income

- Account for depreciation differences

- Consider related party transaction adjustments

Step 3: Access the EmaraTax Portal

Login Requirements:

- Use UAE Pass or EmaraTax credentials

- Ensure you have appropriate filing permissions

- Verify entity information is current

Navigate to Corporate Tax Section:

- Select “Corporate Tax” from the main menu

- Choose “File Tax Return”

- Select the appropriate tax period

Step 4: Complete the Tax Return Form

Section A: Entity Information

- Verify all entity details are correct

- Update any changes in business activities

- Confirm contact information

Section B: Income Calculation

- Enter accounting profit/loss

- Apply all necessary adjustments

- Calculate preliminary taxable income

Section C: Deductions and Reliefs

- Claim all eligible deductions

- Apply small business relief if qualifying

- Calculate final taxable income

Section D: Tax Calculation

- Apply appropriate tax rates

- Calculate total tax liability

- Account for any tax credits or payments

Step 5: Review and Submit

Final Review Checklist:

- Verify all calculations are accurate

- Ensure supporting documents are attached

- Confirm all mandatory fields are completed

- Review summary information

Submission Process:

- Generate and review the tax return summary

- Submit electronically through the portal

- Receive confirmation and reference number

- Save submission receipt for records

Step 6: Payment Processing

Payment Methods Available:

- Online payment through EmaraTax portal

- Bank transfer to FTA account

- Payment at authorized collection centers

Payment Timing:

- Payment must be made by the filing deadline

- Late payment penalties apply if missed

- Installment plans may be available for qualifying taxpayers

Understanding Taxable Income: What Counts and What Doesn’t

Taxable Income Categories

Business Income:

- Revenue from core business activities

- Service fees and consulting income

- Rental income from business properties

- Gains from asset disposals

Investment Income:

- Dividend income (subject to participation exemption rules)

- Interest income from business investments

- Capital gains (with specific exemptions)

- Foreign income subject to UAE tax

Other Income Sources:

- Forgiveness of debt

- Government grants and subsidies (with exceptions)

- Insurance proceeds exceeding basis

- Barter transaction values

Exempt Income Categories

Dividends: Subject to participation exemption if specific conditions are met

Capital Gains: Exempt under certain circumstances, particularly for qualifying shareholdings

Government Grants: Specific exemptions for certain types of government support

Insurance Proceeds: Exempt to the extent they compensate for losses

Timing of Income Recognition

Accrual Method: Income recognized when earned, regardless of payment receipt

Cash Method: Income recognized when received (limited availability)

Specific Timing Rules: Apply to certain types of income like long-term contracts

Allowable Deductions and Expenses: Maximizing Your Tax Efficiency

Wholly and Exclusively Business Expenses

Qualifying Criteria:

- Expenses must be incurred wholly and exclusively for business purposes

- Must be supported by proper documentation

- Should be reasonable in amount and nature

Common Deductible Expenses:

- Employee salaries and benefits

- Rent and utilities for business premises

- Professional services fees

- Marketing and advertising costs

- Equipment and software expenses

- Business travel and entertainment (subject to limits)

Depreciation and Amortization

Acceptable Methods:

- Straight-line depreciation

- Accelerated depreciation for qualifying assets

- Amortization of intangible assets

Qualifying Assets:

- Plant and machinery

- Office equipment and furniture

- Vehicles used for business

- Computer equipment and software

- Buildings and improvements

Specific Deduction Limitations

Entertainment Expenses: Limited to 50% of actual costs

Penalties and Fines: Generally not deductible

Capital Expenditure: Must be depreciated rather than expensed immediately

Related Party Transactions: Subject to transfer pricing rules

Strategic Deduction Planning

Timing Considerations:

- Accelerate deductible expenses where possible

- Consider timing of asset purchases for optimal depreciation

- Plan discretionary expenses around tax year-ends

Documentation Requirements:

- Maintain detailed records of all expenses

- Ensure proper supporting documentation

- Implement robust expense approval processes

Understanding Tax Groups and Their Implications

What is a Tax Group?

A tax group allows multiple UAE resident entities under common control to be treated as a single taxpayer for corporate tax purposes. This can provide significant administrative and financial benefits for multi-entity businesses.

Eligibility Requirements

Ownership Threshold: Parent entity must own at least 95% of each subsidiary

UAE Residency: All entities must be UAE tax residents

Common Control: Must be under common control or management

Election Timing: Group election must be made before the relevant tax period

Benefits of Tax Group Formation

Administrative Efficiency:

- Single tax return for the entire group

- Consolidated compliance requirements

- Simplified reporting processes

Financial Advantages:

- Offset losses of one entity against profits of another

- Eliminate intercompany transactions

- Optimize overall group tax position

Operational Benefits:

- Streamlined cash management

- Reduced compliance costs

- Enhanced transfer pricing flexibility

Potential Drawbacks and Considerations

Loss of Individual Entity Control: Some entities may lose independence in tax matters

Exit Complications: Leaving a tax group can be complex and costly

Joint Liability: Group members may be jointly liable for tax obligations

Administrative Requirements: Additional documentation and monitoring needed

Tax Group Management Best Practices

Regular Reviews: Continuously assess the benefits and drawbacks of group status

Documentation: Maintain comprehensive records of group structure and changes

Professional Advice: Engage tax professionals for complex group arrangements

Planning: Consider long-term business plans when making group elections

Conclusion

Successfully navigating UAE corporate tax filing in 2025 requires technical knowledge, strategic planning, and ongoing compliance attention. The system has matured with clearer guidance and streamlined processes for business owners.

Success depends on understanding your obligations, maintaining excellent records, and staying informed about regulatory developments. Corporate tax compliance isn’t just about meeting minimum requirements—it’s an opportunity to optimize your tax position while contributing to the UAE’s economic development.

By following this comprehensive guidance and partnering with experienced consultants like Horizon Biz Consultancy, you can ensure compliance while positioning your business for continued success. At Horizon Biz Consultancy, we transform complex compliance requirements into efficient, manageable processes that support your business growth.

The UAE’s corporate tax system represents a new chapter in economic development, and businesses that embrace these changes with proper planning and expert guidance will thrive in this evolved landscape.

FAQ’s

A: If your taxable income is AED 375,000 or below, you’ll pay 0% corporate tax. However, you’re still required to register for corporate tax if your revenue exceeds AED 1 million and file annual returns regardless of your tax liability.

A: You can file your own corporate tax return through the EmaraTax portal. However, appointing a registered tax agent is mandatory for certain entities, including large businesses and those meeting specific criteria set by the FTA.

A: Small business relief provides a 0% tax rate for businesses with annual revenue not exceeding AED 3 million, provided they meet qualifying conditions. This relief is automatic for eligible businesses and doesn’t require a separate application.

A: Penalties include administrative fines starting from AED 10,000 for late filing, plus 5% of tax due for each complete month of delay. Serious non-compliance can result in additional penalties and potential business license suspension.

A: Free zone entities must maintain adequate substance, earn only qualifying income, and meet ongoing compliance requirements. They must conduct core income-generating activities in the UAE and avoid significant domestic transactions.

A: Yes, tax losses can generally be carried forward indefinitely, subject to certain conditions and restrictions. However, specific rules apply to different types of losses and business changes.

A: Maintain comprehensive records including audited financial statements, general ledgers, invoices, receipts, contracts, and supporting documentation for all transactions. Records should be kept for at least 5 years.