Introduction

When it comes to business valuation, myths are everywhere.

Many founders and investors still rely on oversimplified shortcuts, leading to either missed opportunities or inflated expectations.

In reality, valuation is both an art and science.

Especially in dynamic markets like the UAE, understanding local nuances can mean the difference between closing a strategic deal and losing investor interest.

Today, let’s see the 5 most common valuation myths and set the record straight.

Myth 1: P/E Ratio Tells You Everything

Reality:

The Price-to-Earnings (P/E) ratio is a helpful tool for mature, listed companies with stable earnings.

But if you run a private company, it’s risky to blindly apply public market multiples.

Adjusted earnings adjustments are like one-off expenses and incomes, such as impairments, profits/losses on the sale of PPE, and working capital anomalies, which are non-operational and non-recurring.

Private valuations require adjusted earnings, risk analysis, and growth projections tailored to your business, not just shortcuts.

Insight:

Use P/E ratios carefully, complemented with private company valuation methods, or risk over- or under-valuing by a large margin.

Myth 2: DCF is the Most Accurate Valuation Method

Reality:

The Discounted Cash Flow (DCF) method is a gold standard only when your future cash flows are reasonably predictable.

Scenario-based DCF with base case, best case or worst case can improve DCF for volatile businesses

For startups, volatile industries, or early-stage companies, DCF becomes an assumption-heavy model that can mislead both founders and investors.

Tip:

Use DCF when your historical data trends support future projections. Otherwise, combine it with other methods like comparable company analysis or strategic valuation frameworks.

Myth 3: We’ll Apply a Standard 5x EBITDA Multiple Like Others

Reality:

There’s no “one-size-fits-all” EBITDA multiple.

It varies by sector, region, entity structure, and even buyer perception.

For instance, a Dubai Mainland business might command a different multiple compared to a Free Zone company due to regulatory, tax, and operational differences.

- Subscription-based SaaS businesses command higher EBITDA multiples compared to project-based, one-off revenue models.

- A strong competitive edge and defensible market position (moat) significantly enhance valuation multiples.

- High customer concentration negatively impacts EBITDA multiples due to increased dependency risk.

Pro Tip:

Understand your capital structure, risk profile, and regulatory obligations before anchoring to any multiple.

Myth 4: Only Revenue or Profit Drives Valuation

Reality:

Strategic value often outweighs short-term financials.

Buyers don’t just acquire numbers; they acquire future potential.

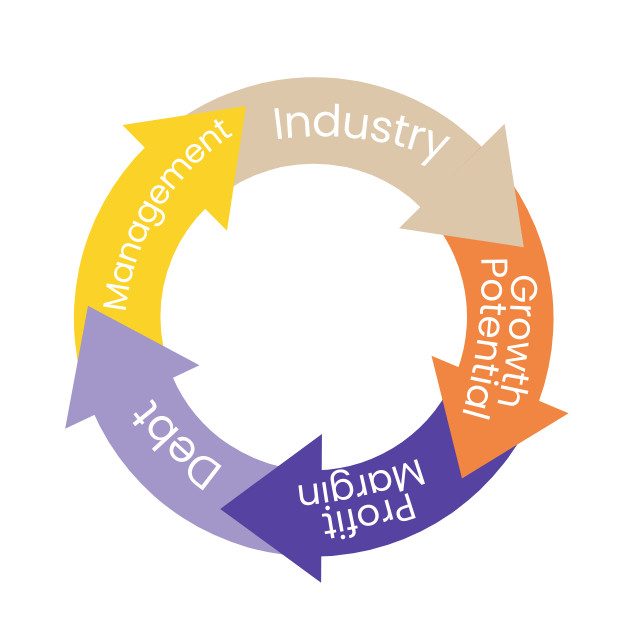

Key strategic factors that can boost valuation:

- Intellectual Property (IP)

- Market niche leadership

- Recurring revenue models

- Operational scalability

- Brand strength

Strategic buyers might pay for a control premium and synergies.

Lesson:

Highlight your strategic differentiators during valuation discussions, it’s often where the premium lies.

Myth 5: Valuation Only Matters During Fundraising

Reality:

Valuation isn’t a one-time event; it’s a continuous strategic tool.

Regular valuations help with:

Waiting until you’re fundraising or exiting often leads to rushed, sub-optimal valuations that don’t reflect your true worth.

Advice:

Stay deal-ready with periodic, realistic valuation reviews.

UAE-Specific Factors That Impact Valuation

Valuation in the UAE comes with its own unique layers:

- Ownership Structure: (Mainland vs Free Zone)

- Regulatory Changes: (e.g., Corporate Tax at 9%)

- Market Access Advantage: (Gateway to GCC and Africa)

- Investor Appetite: (DIFC, ADGM, Venture Capital influx)

Geography isn’t just about location; it defines legal risk, tax efficiency, and market premium.

Conclusion

Valuation is Not Just About Numbers, It’s About Your Narrative, The best valuations are built on:

- The right method

- The right timing

- The right story

Whether you’re fundraising, restructuring, or planning an exit, Horizon Biz Consultancy helps you create a valuation narrative that reflects your true, strategic worth, not just a spreadsheet number.

FAQs

Many believe P/E ratios or DCF methods always work, but private businesses require tailored approaches based on risk, market, and growth factors.

Because startups often have unpredictable cash flows, making DCF (Discounted Cash Flow) models are highly speculative.

Multiples change based on whether the company is in a Free Zone or Mainland, plus factors like tax position, capital structure, and regulatory risk.

Strategic assets like intellectual property (IP), recurring revenue, and niche market dominance often drive higher valuations.

Regular valuation checkpoints help with ESOP planning, shareholder agreements, restructurings, and M&A opportunities, not just fundraising.